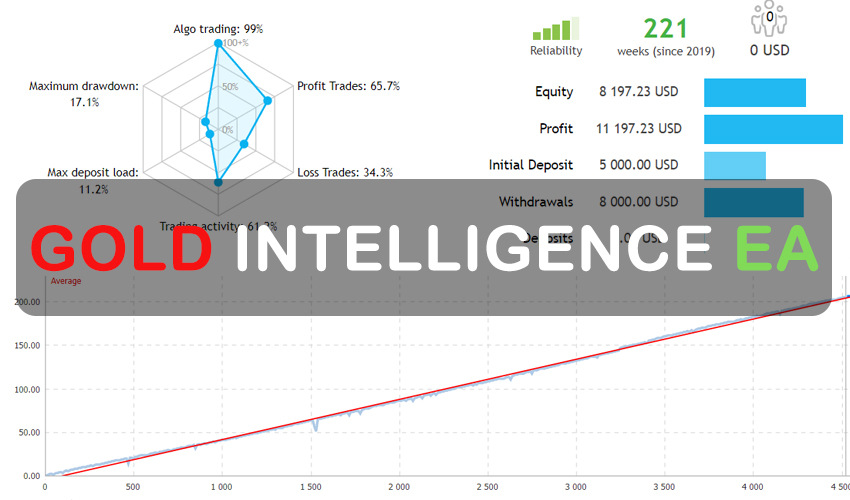

Gold Intelligence EA is an automated Gold Forex Robot specifically designed for trading the XAUUSD (GOLD) pair. This sophisticated trading robot harnesses the power of advanced neural networks within a unique neuroscanner framework. In this article, we explore the capabilities, advantages, and realistic expectations surrounding Gold Intelligence EA.

NeuroScanner Technology: The Heart of Gold Intelligence EA

Advanced Neural Networks

At the core of Gold Intelligence EA is its advanced neural network technology, known as “neuroscanner.” This technology allows the EA to analyze both historical and current market data with exceptional accuracy. While many developers claim to use neural networks, it is crucial to differentiate between mere marketing jargon and genuinely effective implementations. Gold Intelligence EA’s technology stack includes several specialized neural plugins, each enhancing different aspects of trading:

Key Plugins in Gold Intelligence EA

NeuroScanner Pro

This plugin excels in real-time data analysis and pattern recognition, quickly adapting to new market conditions. Its precision in identifying potential trading opportunities is a significant asset for traders.

NeuroTrend Predictor

This tool strengthens the EA’s strategic decision-making capabilities by analyzing historical data to forecast future market trends.

NeuroRisk Manager

Focused on minimizing financial risk, this plugin dynamically adjusts trade sizes and strategies in response to fluctuating market conditions, protecting the trader’s capital.

NeuroProfit Optimizer

This component optimizes the timing for trade entries and exits, aiming to maximize profits and minimize losses through strategic trade management.

Advantages of Gold Intelligence EA

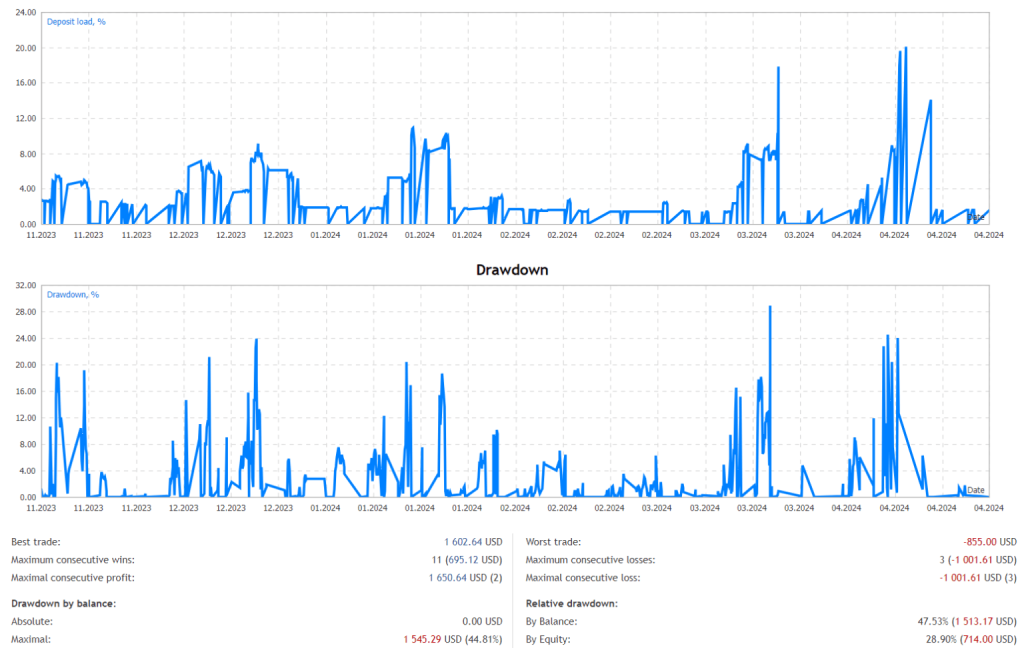

Gold Intelligence EA is engineered to avoid high-risk money management tactics such as the martingale strategy, grid trading, or averaging. It employs hard stop loss and take profit measures for each trading position, adding a layer of security to its operations. Here are several advantages that set Gold Intelligence EA apart:

Safe Money Management

The EA avoids risky methods like martingale, grid, or averaging, which are often criticized for their potential for significant losses.

Hard Stop Loss and Take Profit

Each trading position is secured with predefined stop loss and take profit points, enhancing safety and predictability.

Adaptation to Leverage

Gold Intelligence EA automatically adjusts its risk levels based on the leverage, providing a balanced trading approach.

Compatibility with Trading Firms

It is suitable for FTMO and proprietary trading firms, particularly when set to low risk.

User-friendly Setup

All settings are internally coded, eliminating the need for external configuration files. Traders can select their preferred risk levels directly in the user interface.

Built-In News Filter

An integrated news filter blocks trading activities around significant market news, reducing exposure to high volatility.

Broker Compatibility

While not overly sensitive to broker conditions, performance may vary with different brokers.

Recommendations for Using Gold Intelligence EA

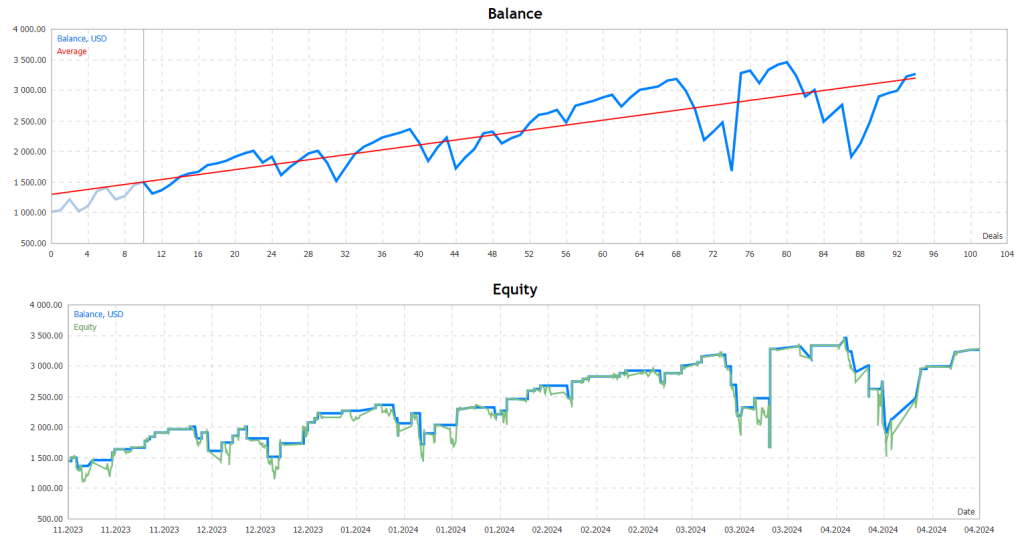

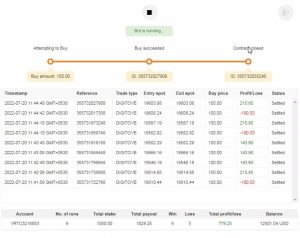

Potential users should approach the claims of advanced neural technologies with a healthy dose of skepticism. Many EA developers tout advanced technologies, but the true test lies in real-world performance and verifiable, back-tested results. Traders are advised to seek out independent reviews and performance analytics before fully committing to any trading system.