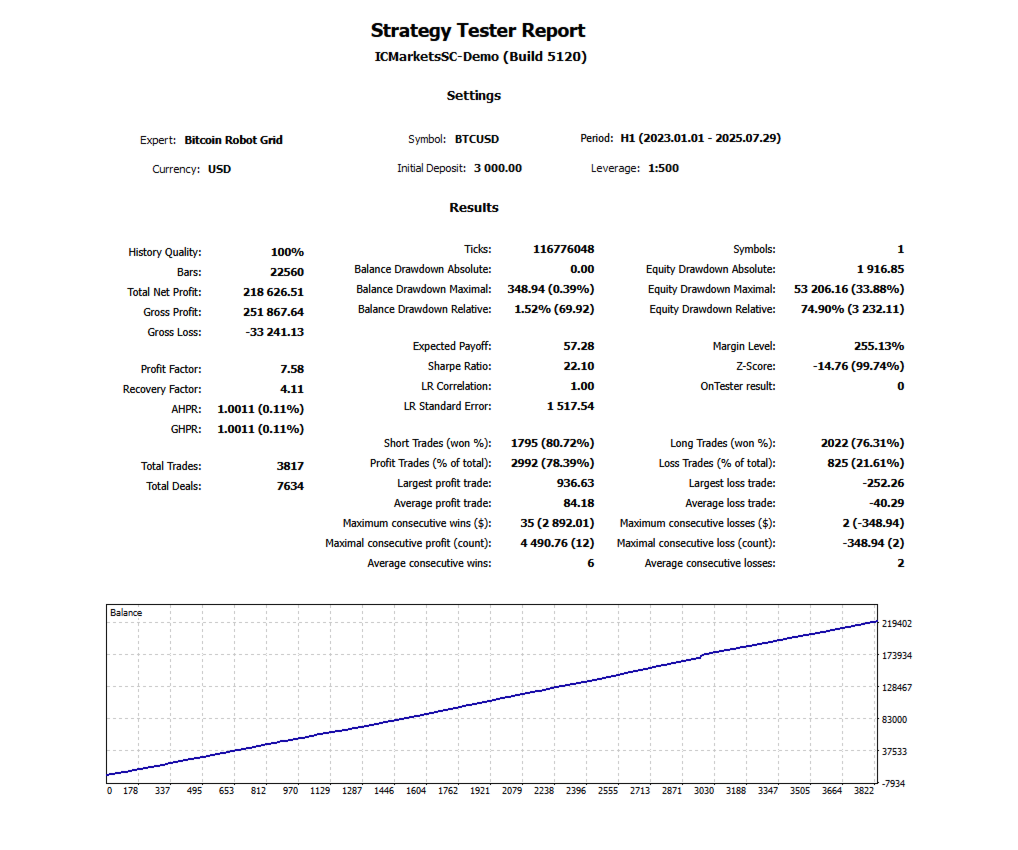

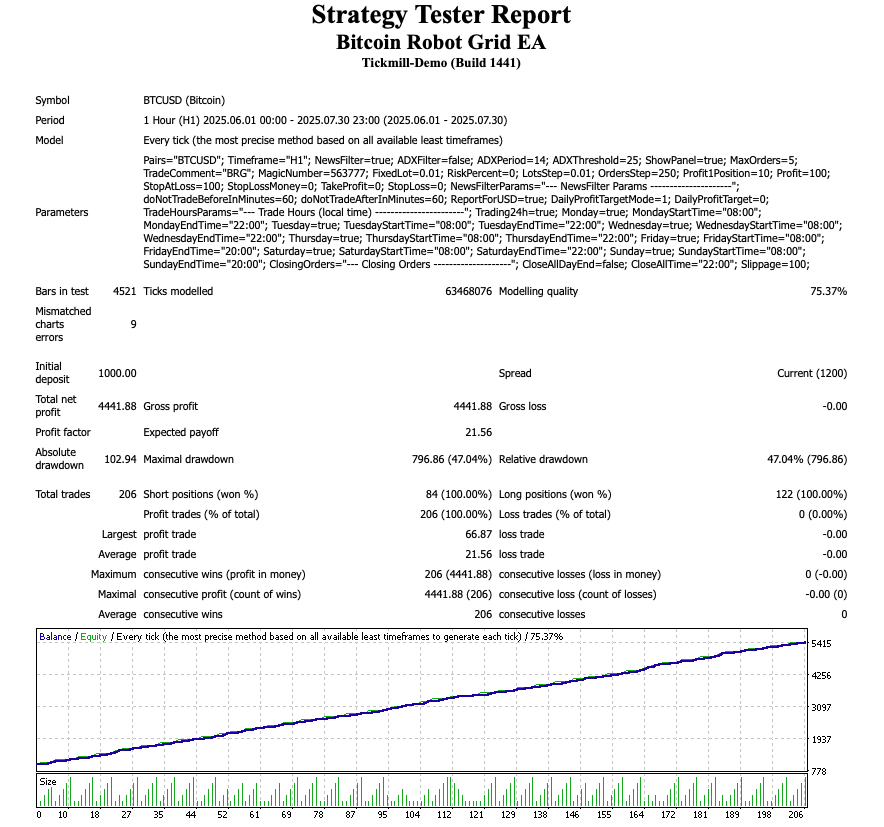

Bitcoin Robot Grid is a specialized Grid EA developed for the MT4 platform. Designed specifically to handle the volatility of the crypto market, this robot serves as a comprehensive solution for Automated BTCUSD Trading. By employing a structured series of buy and sell orders at predefined price levels, the system aims to capitalize on market fluctuations without requiring manual execution from the trader.

Core Grid EA Strategy

The fundamental mechanism behind this Bitcoin Robot Grid software is the classic Grid EA strategy. This method involves creating a “grid” of orders above and below a set price. As the market price fluctuates, these orders are triggered mechanically.

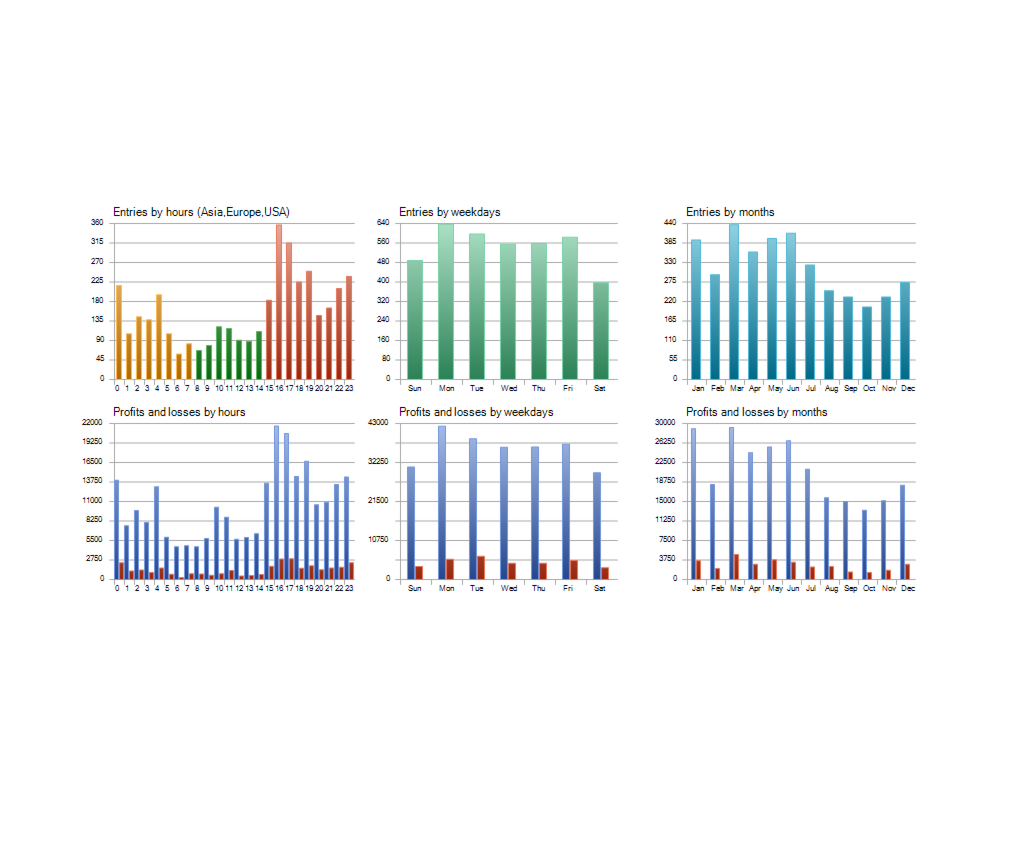

The robot continuously monitors market conditions to execute these trades according to preset parameters. This approach is designed to take advantage of the natural volatility of Bitcoin, aiming to profit from price movements in either direction. The system operates 7 days a week, engaging with the crypto market’s continuous hours, or it can be configured to trade on specific days and hours.

Key Features of this Bitcoin Robot Grid

This Grid EA includes several technical features designed to manage entry points and risk during Automated BTCUSD Trading:

- News Filter – To mitigate risks associated with high-impact economic events, the robot includes a news filter. This feature prevents the system from opening new positions 60 minutes before and 60 minutes after significant news releases, protecting the account from unpredictable volatility spikes.

- ADX Filter – The system utilizes the Average Directional Index (ADX) to gauge trend strength before executing trades, adding a layer of technical analysis to the grid logic.

- Risk Management – All positions are designed to be protected by Take Profit and Stop Loss levels. Additionally, the system includes a MaxDD% (Maximum Drawdown) parameter to limit exposure.

Recommendations

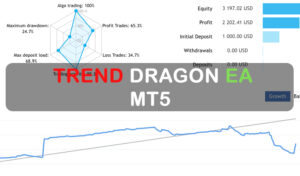

- Minimum account balance of 1000$.

- It is specifically made to trade on BTCUSD (Bitcoin).

- It works on H1. (Work on any TimeFrame)