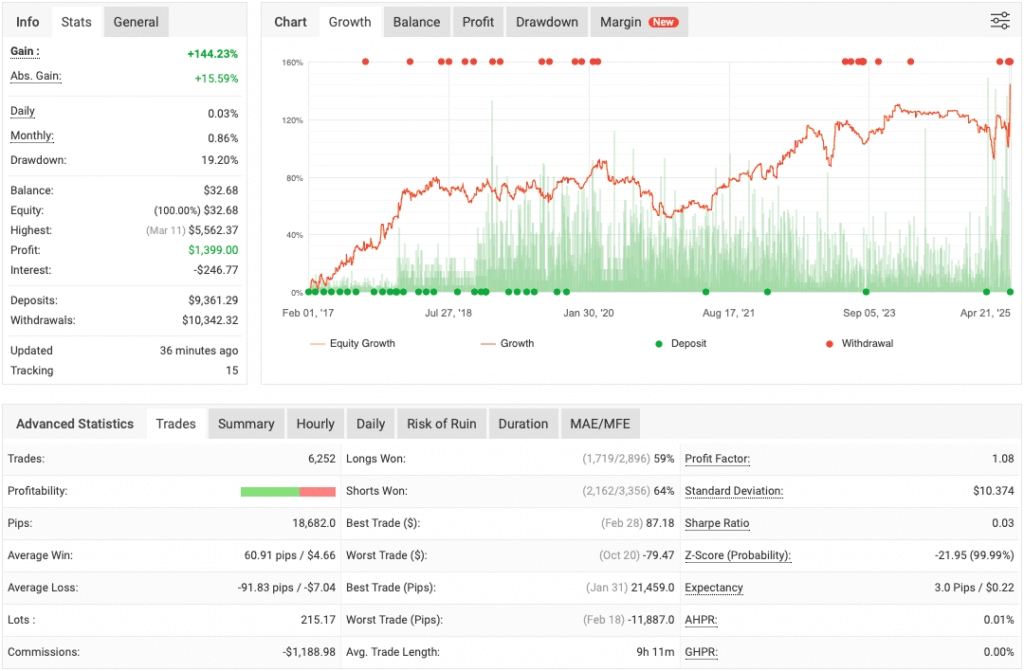

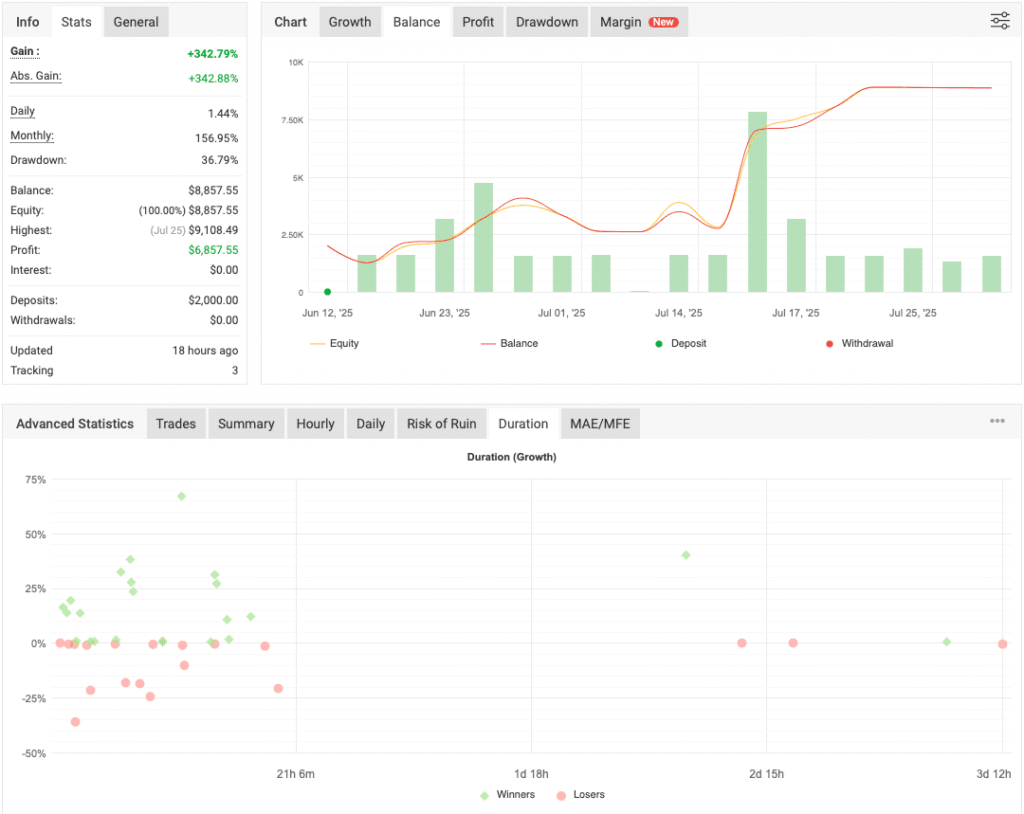

Belkaglazer EA is an Expert Advisor designed for the MetaTrader platform, offering traders a wide scope to build and execute algorithmic trading strategies across various financial markets, including FOREX, FORTS, cryptocurrency, and indices. The software is structured around four core trading models, Price Channel, Pivot, Price Action, and PRNG, each of which can be configured and customized to support a broad range of trading styles and strategy types.

Core Models and Strategies of Belkaglazer EA

At the heart of the Belkaglazer EA are its trading models, which permit users to construct strategies for different market conditions. These include,

- Price Channel (PCh) – Uses horizontal support and resistance levels based on past price extrema, usable in both breakout and mean reversion strategies.

- Pivot – Calculates support and resistance using pivot points derived from a central line formula based on historical price data and the ATR (Average True Range).

- Price Action (PA) – Leverages classic price movement patterns to detect potential entry points, particularly useful in seasonal or trend-following contexts.

- PRNG (Pseudo-Random Number Generator) – Generates signals in a random direction, primarily geared towards research, stress testing, or experimentation such as Monte Carlo simulations.

Each of these models can support various strategy classifications, from momentum and breakout to mean reversion approaches. The software allows for detailed parameter adjustment to refine the behavior of these models, such as offset levels in the Price Channel model or trading frequency in the PRNG model.

The inclusion of a “[None]” model enables signal generation without using predefined models, relying solely on filters for signal determination. This can suit users aiming for maximum customization.

Strategy Types

Belkaglazer EA is capable of executing several types of algorithmic strategies,

- Breakout – Targets price movement beyond pre-defined support or resistance levels, typically placing stop orders at those levels.

- Momentum – Capitalizes on continued price trends by executing market orders in the direction of recent strong movements.

- Mean Reversion – Trades against prevailing trends on the assumption that extreme price actions will revert to the mean. Employs limit or market orders near support/resistance levels.

Given suitable parameter settings and model combinations, Belkaglazer EA can also be programmed to run scalping or counter-trend strategies.

Filters and Risk Management

A distinguishing feature of Belkaglazer EA is its layered filtering system, which is intended to refine trade quality by restricting entries to more favorable market conditions. Available filters include:

- Trend filters (e.g., Daily EMA, HL/2)

- Volatility filters (intraday and daily ATR-based measurements)

- Time-based filters (minute, hour, day, and month settings)

- News filter (includes backtesting ability and various data providers)

- CBOE VIX filter (used as a proxy for market instability or crash risk)

- Other technical filters, such as RSI and range indicators

While filters can help increase the average profitability per trade and reduce suboptimal entries, the documentation acknowledges that overuse may result in overfitting, thereby reducing robustness in live trading environments. Importantly, filters are positioned as tools to enhance already profitable strategies rather than to convert unprofitable ones.

Order Types and Execution

Belkaglazer EA supports various order types, including limit, stop, and direct market orders. It is compatible with both Instant and Market execution models and detects 4 digit and 5 digit brokerage quotes automatically.

Order execution features also include optional execution delays and the use of take profit, stop-loss, time-stop, and trailing-stop mechanisms. Every trade is protected by a stop loss, and the EA does not rely on conventional grid or martingale hedging systems by default.

Money Management

The EA presents a comprehensive suite of Money Management (MM) tools, including:

- Fixed lots, Proportional lots, % Margin, and Max. risk per trade

- Optimal F strategies for compounding

- Optional integration of higher-risk methods such as Martingale, Anti-Martingale, Averaging, and Pyramiding

These MM strategies can be layered onto any trading approach built within the EA. Notably, while the EA itself doesn’t default to employing risky MM techniques, the flexibility to include them is present.

Recommendations

- Minimum Account Balance of 100$.

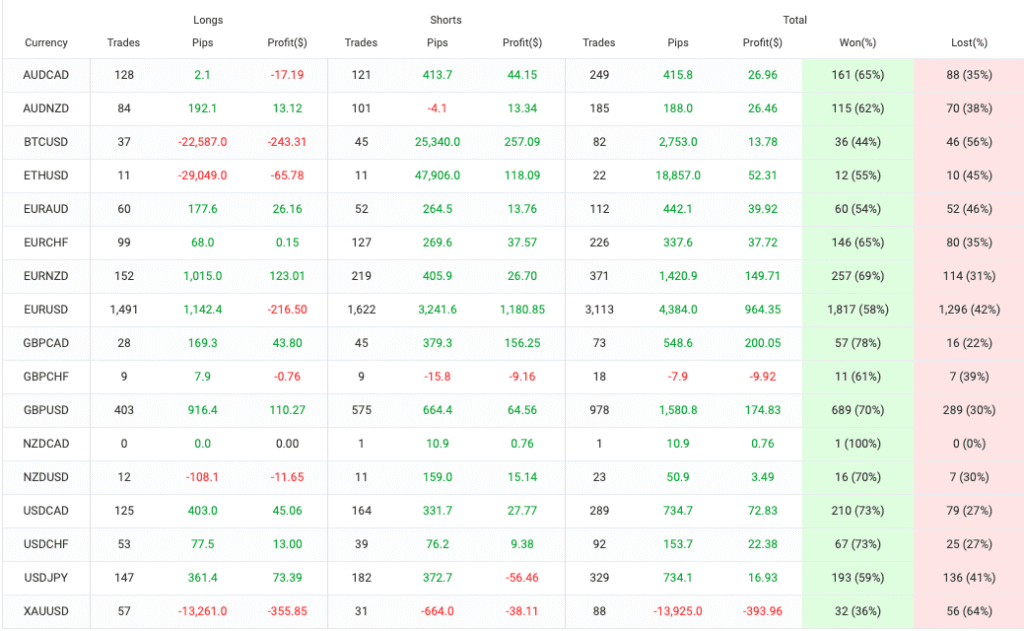

- Work Best on EURUSD, GBPUSD, and GBPJPY(It can be fine-tuned to work on any Pair)

- Work Almost the same on most TimeFrame.