Introduction

Learn how MoneTree EA revolutionizes forex trading with its automated strategies, promising high returns while mitigating risks.

Understanding MoneTree EA

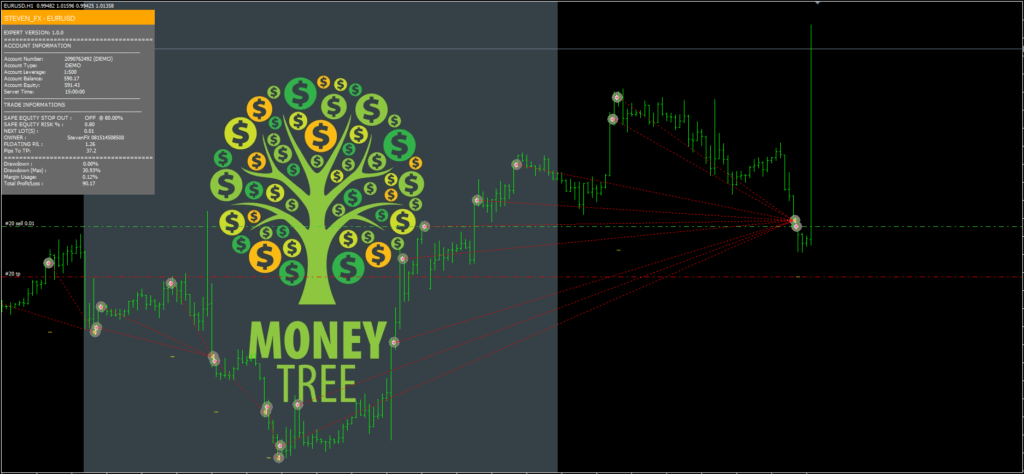

Discover the intricate blend of hedging-martingale and high-frequency trading (HFT) averaging strategies employed by MoneTree EA to optimize profits and minimize risks in the volatile forex market.

Operating MoneTree EA

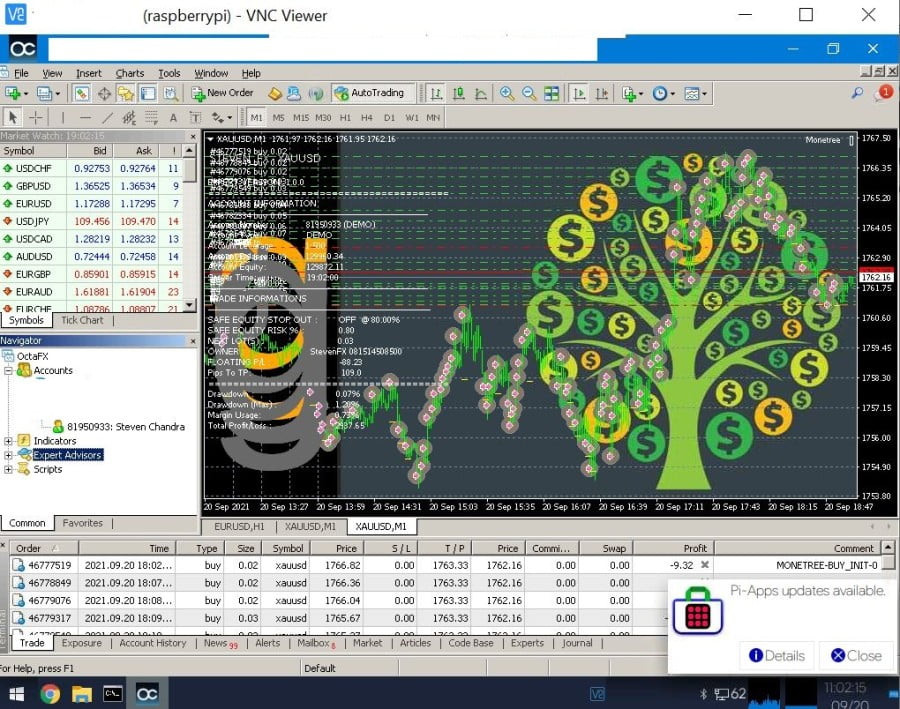

Unlock the potential of MoneTree EA by understanding its file structure and the significance of running both Monetree_BUY and Monetree_SELL simultaneously on separate EURUSD charts.

Managing Risk Exposure

Navigate the risk landscape by grasping the correlation between timeframe attachment and risk exposure, ensuring a balanced approach to profitability and security.

Strategies for Success

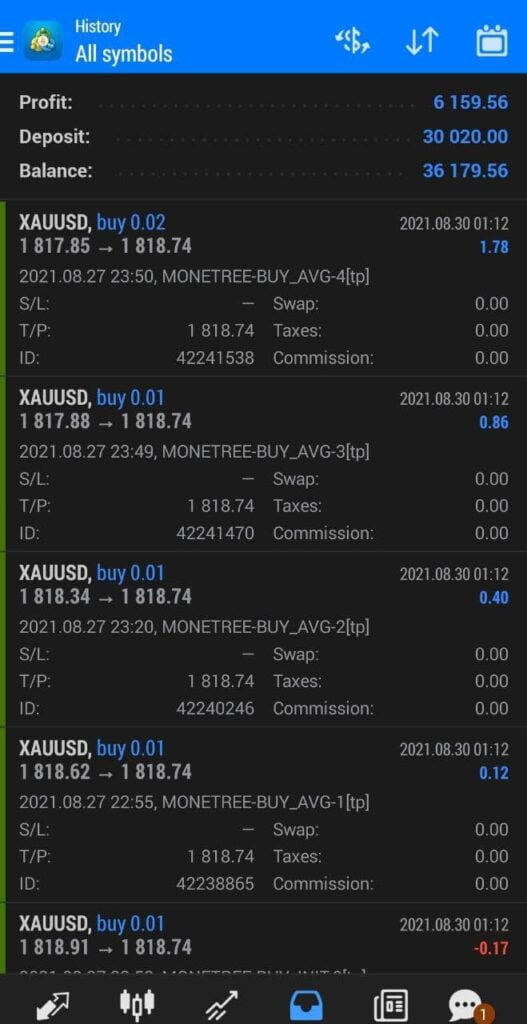

Delve into the hybrid martingale and hedging methods utilized by MoneTree EA, ensuring a high return on investment (ROI) with stable performance while managing occasional risks.

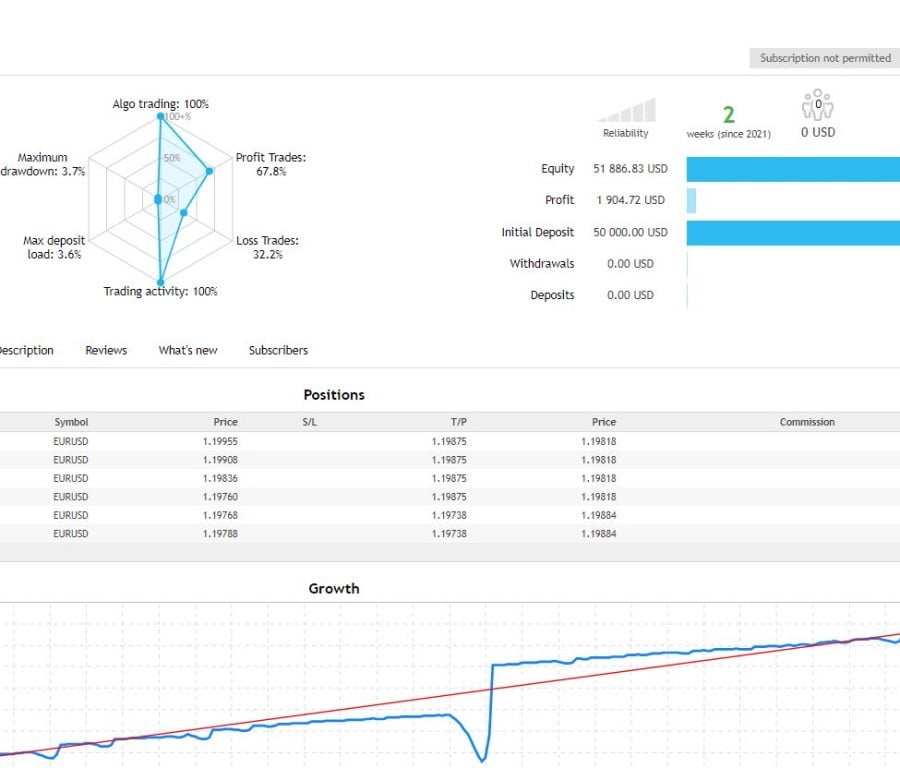

Calculating Potential Profits

Explore the factors influencing monthly profits, such as lot size and risk value, to tailor MoneTree EA’s performance to your financial goals.

Effective Implementation

Follow step-by-step instructions to deploy MoneTree EA safely and effectively, including the recommended minimum account balance and optimal timeframes for maximum efficiency.

Recommendations for Risk Mitigation

Understand the critical importance of running two instances of MoneTree EA simultaneously to activate its hedging strategy fully, preventing potential losses and ensuring successful trading outcomes.

Conclusion

Embrace the innovative approach of MoneTree EA to automate forex trading, revolutionizing your trading experience with its dynamic strategies for sustainable profitability.