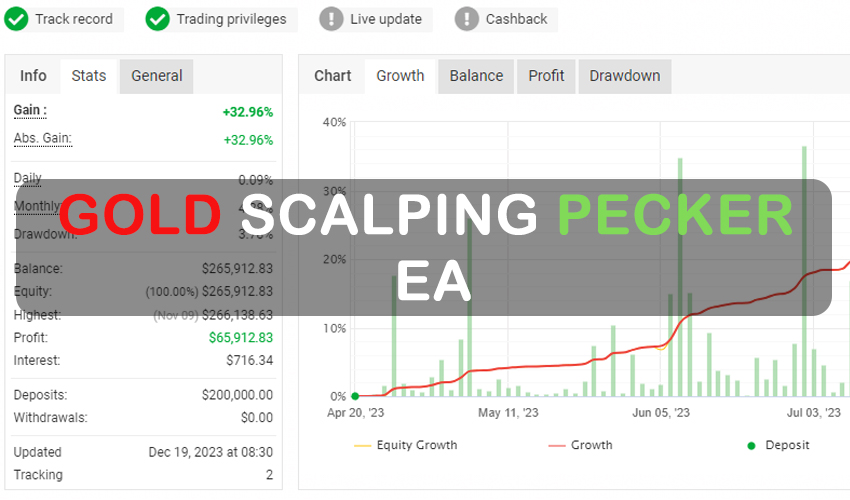

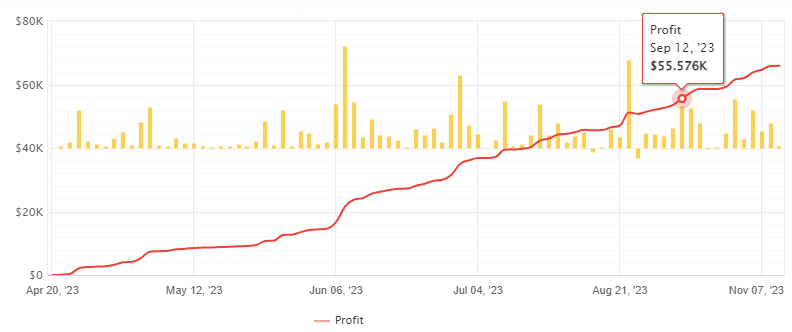

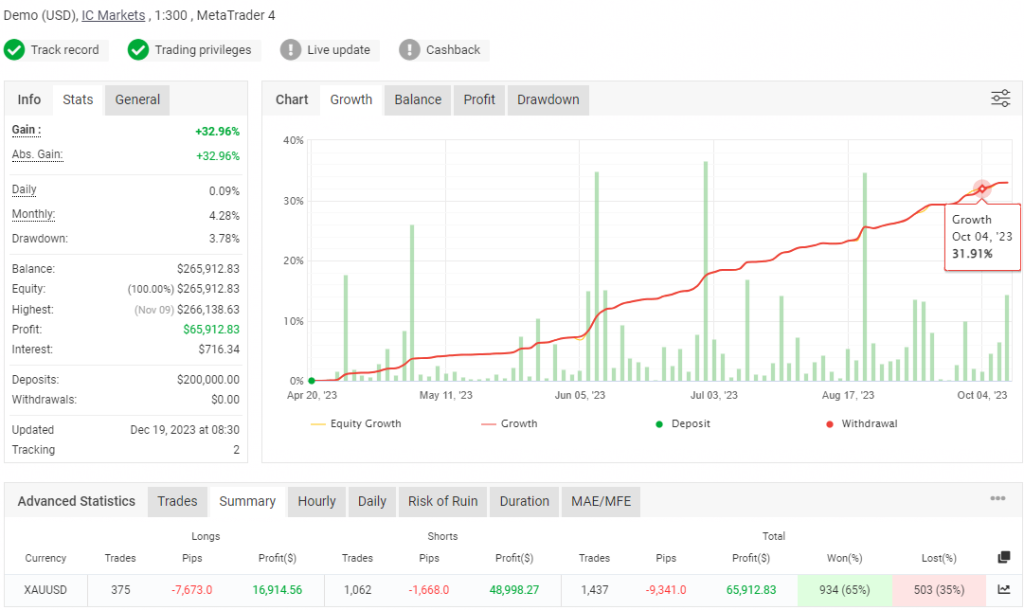

The Pecker EA, specifically designed for the XAUUSD (Gold) market, stands out with its sophisticated algorithms aimed at enhancing profit potential. This expert advisor (EA) has been gaining traction among traders, promising a blend of advanced trading features and risk management strategies. But how does it really perform under scrutiny?

Innovative Trading Features and Flexibility

Pecker EA is tailored to support both novice and seasoned traders by accommodating various trading strategies, including scalping and swing trading. Its versatility is further amplified by a flexible Martingale system, which adapts to changing market conditions, and claims of highly accurate entry points that leverage cutting-edge algorithmic technology.

Built-in Risk Management and Accessibility

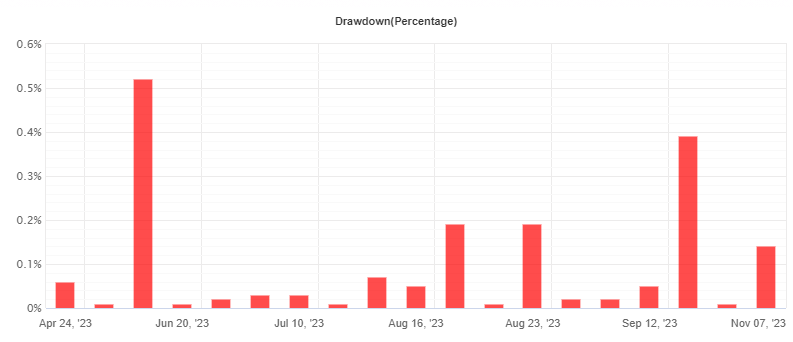

A standout feature of the Pecker EA is its approach to risk management. It offers built-in protection measures to safeguard traders’ accounts and is accessible to those starting with as little as $100. This makes it an attractive option for traders seeking to experiment with gold trading without committing substantial financial resources. Moreover, the EA boasts low drawdowns, promoting a more stable and reliable income from trading activities.

Adapting to Market Changes with Advanced Tools

The inclusion of a news filter allows the Pecker EA to avoid periods of high market volatility associated with major economic announcements, thereby protecting traders from unpredictable market swings. This feature, combined with various trading modes tailored to different balance requirements and time frames, ensures that traders can manage their investments according to their individual risk tolerance and trading style.

Practical Trading Recommendations

While the Pecker EA offers various default settings, it is highly recommended that traders utilize one of the three provided configuration files to optimize their trading outcomes:

- Low Risk: Ideal for beginners with a minimum account balance of $3,000 or an equivalent $30 in a cent account, suitable for the M30 time frame.

- Medium Risk: Targeted at intermediate traders with a minimum account balance of $6,000 or an equivalent $60 in a cent account, designed for the M5 time frame.

- High Risk: Best for experienced traders willing to manage a minimum account balance of $10,000 or an equivalent $100 in a cent account, optimized for the M1 time frame.

Conclusion:

The Pecker EA offers an enticing package for traders looking to capitalize on the gold market. It promises a combination of advanced trading technology and user-friendly features designed to maximize profitability and minimize risk. However, like any trading tool, its effectiveness will ultimately depend on the user’s ability to utilize the EA’s features to their full potential, making informed decisions based on market conditions and personal trading preferences.