Trading in gold, one of the most volatile and challenging financial instruments, requires precision, adaptability, and strong risk management. CyNera EA markets itself as a cutting-edge solution, promising to combine advanced strategies, artificial intelligence, and rigorous testing to deliver optimal results in gold trading. But how does this EA hold up under scrutiny? Let’s dive deeper into its claims and potential pitfalls.

Seller’s Claims – An Advanced, AI-Powered Trading Solution

According to the seller, CyNera MT4 EA integrates state-of-the-art neural network technologies and AI-driven strategies to analyze and adapt to market conditions. Its features include:

- AI-Driven Decision Making – Utilizes neural networks, including neuroevolutionary and Echo State Networks (ESN), to predict price movements and optimize trading strategies.

- Transformer Networks – Claims to analyze market sentiment by processing external factors such as news and economic reports.

- Generative Adversarial Networks (GANs) – Simulates extreme market scenarios to test and improve strategy resilience.

- Dynamic Trading Frequency – Adjusts the number of trades based on market volatility.4

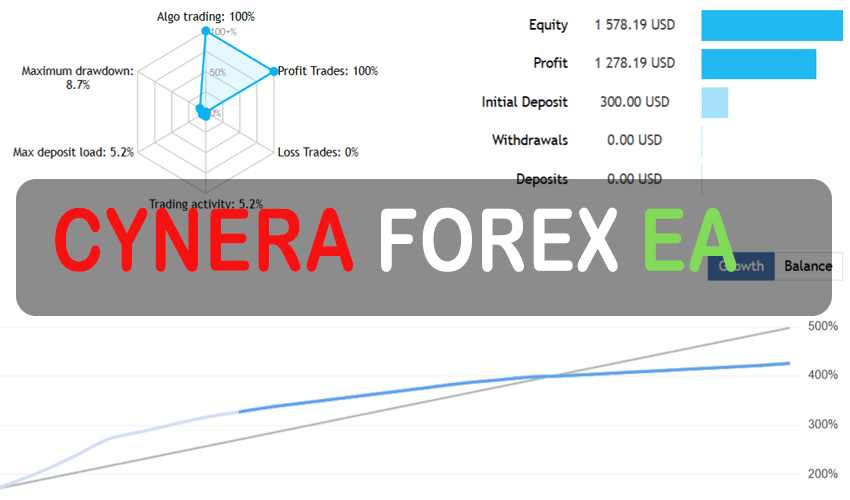

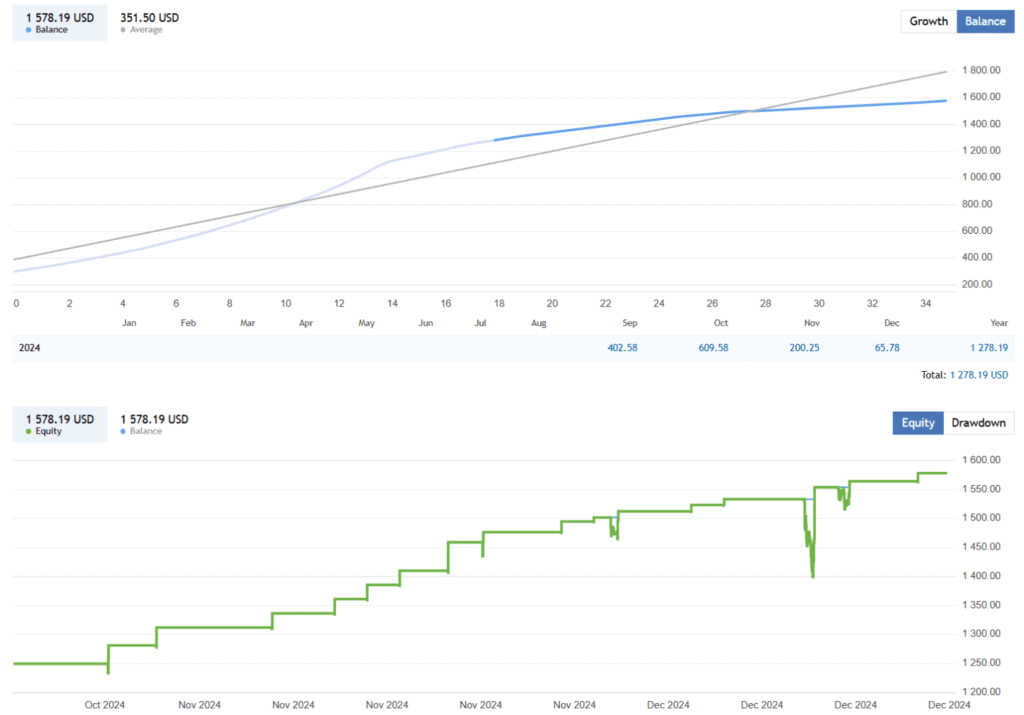

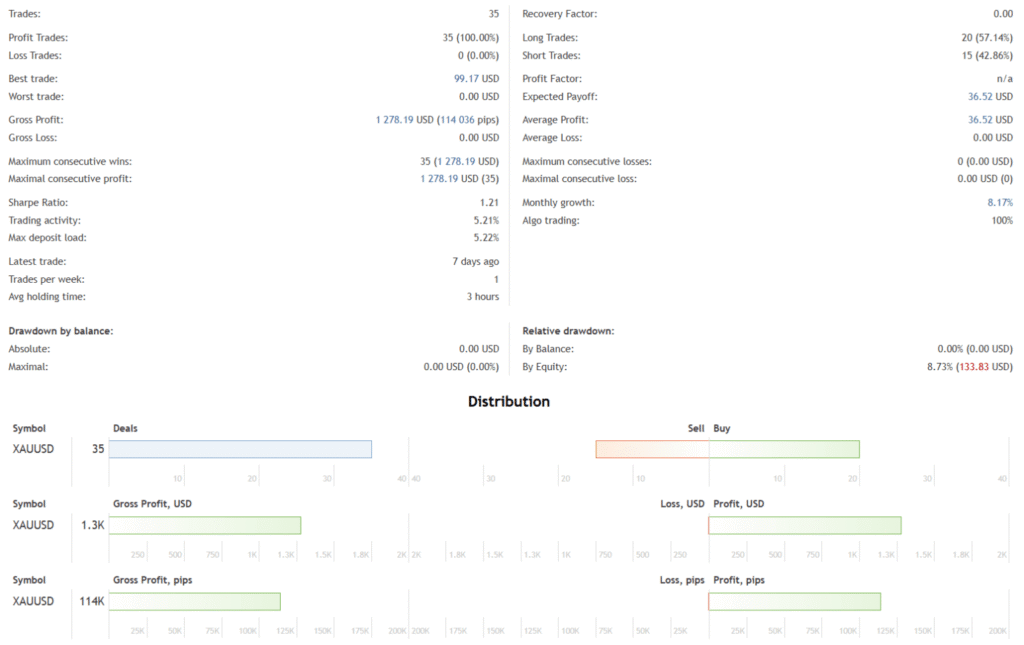

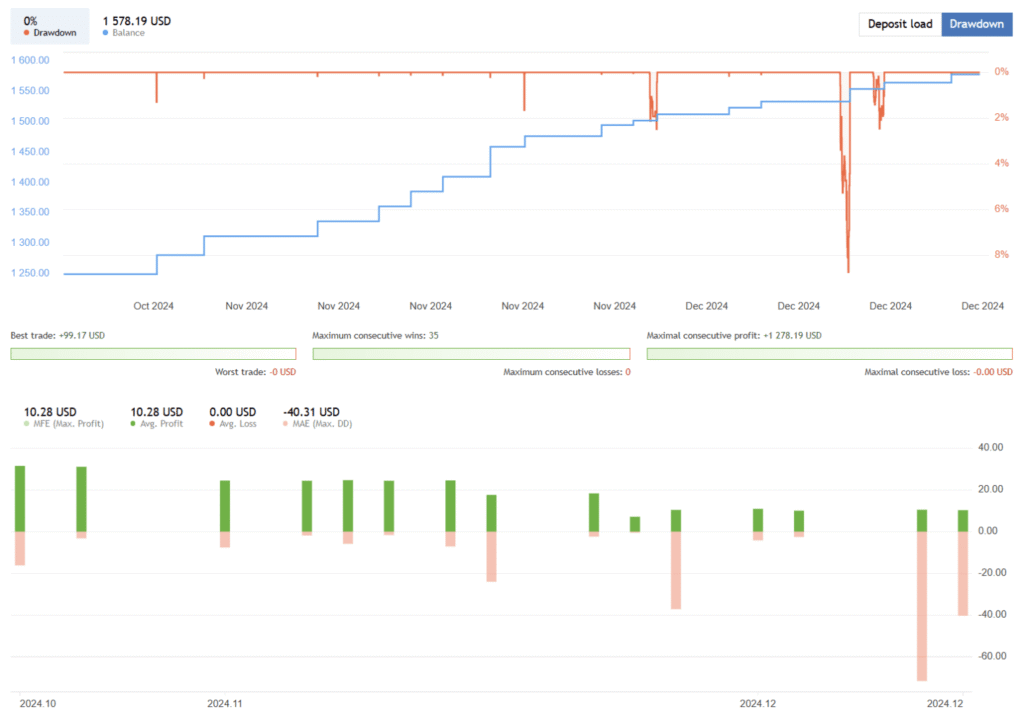

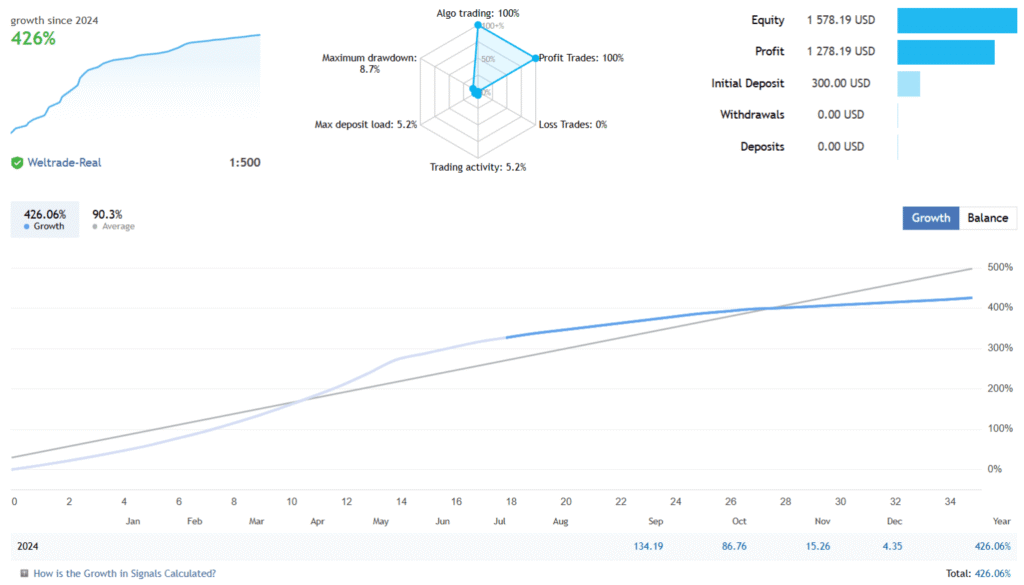

- Proven Performance – Boasts over a decade of backtesting, showing consistent profitability and controlled drawdowns.

- User-Friendly Design – Offers optimized default settings for beginners and customizable options for experienced traders.

The pitch is impressive, filled with technical jargon and promises of precision and adaptability. On paper, CyNera EA sounds like an ideal trading partner for gold EA traders.

The Reality Behind the Glossy Marketing

While the seller’s description paints a picture of a near-flawless tool, experienced traders should cautiously approach such claims. Here’s why:

- Opaque Algorithms – The trading logic of CyNera EA is not disclosed, with vague phrases like “advanced strategies” and “neural network technologies” replacing concrete details. This lack of transparency raises red flags, especially in an industry where clarity is crucial for trust.

- Too-Good-to-Be-True Backtests – The backtests presented often feature a perfectly flat profit curve with minimal drawdowns. Such results are typically achieved through data manipulation, including the exclusion of losing trades or the selective inclusion of historical data that fits the narrative.

- No Groundbreaking Updates – Many similar EAs, including CyNera MT4 EA, offer updates that appear to refine the product but often only add historical data, maintaining the illusion of flawless performance.

- Dubious Marketing Tactics – These EAs are frequently marketed to inexperienced traders, capitalizing on their lack of technical knowledge. The use of complex terminologies and AI buzzwords often serves to obscure rather than clarify the product’s capabilities.

Recommendations

- Minimum account balance of 100$.

- Works best on GOLD. (Work on any Pair)

- Work best on M30 TimeFrame. (Work on any TimeFrame)