Introduction

In the dynamic world of Forex trading, the Adaptive Trading EA stands out as a unique tool designed for traders who are ready to dive deep into market analytics. Unlike many Expert Advisors (EAs) that make grand claims about their capabilities, the Adaptive Trading EA offers a genuinely intelligent approach to trading, focusing on adaptive learning algorithms. This article provides an in-depth look at this innovative trading tool, explaining how it works and why it could be the key to your trading success.

Understanding Adaptive Trading EA

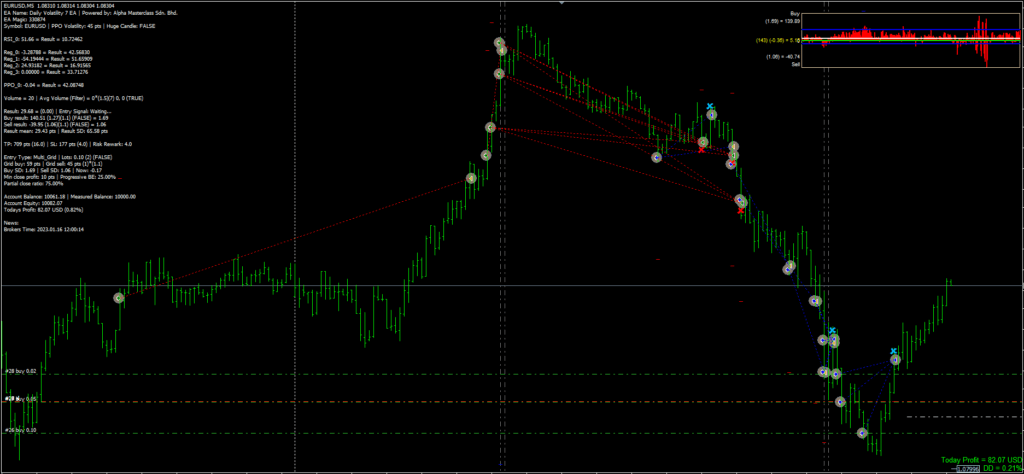

The Adaptive Forex EA is not your average trading bot. It eschews generic, outdated trading models for a robust system that learns from the market. With its advanced learning algorithm, the EA scans past market data to identify the best trading opportunities, adapting its strategy based on historical and current market behaviors.

Data-Driven Trading Decisions

At its core, the Adaptive Trading EA requires a substantial dataset to function effectively. Traders must ensure that the EA has access to at least a month’s worth of chart history before it can begin making trades. This data-driven approach helps the EA to avoid the pitfalls of speculative trading, instead offering decisions grounded in real market activities.

Customization and Control

What sets the Adaptive Trading EA apart is its high level of customization. The system offers detailed documentation of input parameters, allowing traders to tailor it to their specific trading style and strategies. This flexibility can lead to more efficient and potentially more profitable trading outcomes, enhancing user experience significantly.

Optimal Use of Adaptive Trading EA

To get the most out of the Adaptive Trading EA, traders should be prepared to invest time into understanding and configuring the system. The EA is not a simple plug-and-play solution; it requires thoughtful adjustment and ongoing optimization.

Recommendations for Maximum Efficiency

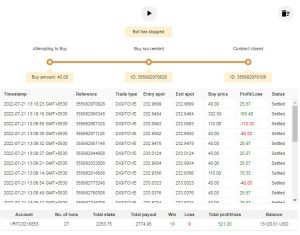

- Minimum Account Balance: A minimum of $100 for 0.01 lot trading is recommended.

- Currency Pairs and Timeframes: While the EA works with all pairs and timeframes, lower timeframes may yield better results. Experimentation with different pairs is encouraged to discover the most effective configurations.

- Data History Verification: Before deployment, verify that the EA has a sufficient data history. If not, data should be downloaded from a historical center or loaded using a script.

Conclusion:

The Adaptive Trading EA is ideal for traders who are not looking for quick fixes but are willing to engage deeply with the tool to refine their trading strategies. Its learning algorithm and customization options provide a powerful platform for those who are serious about their Forex trading career.