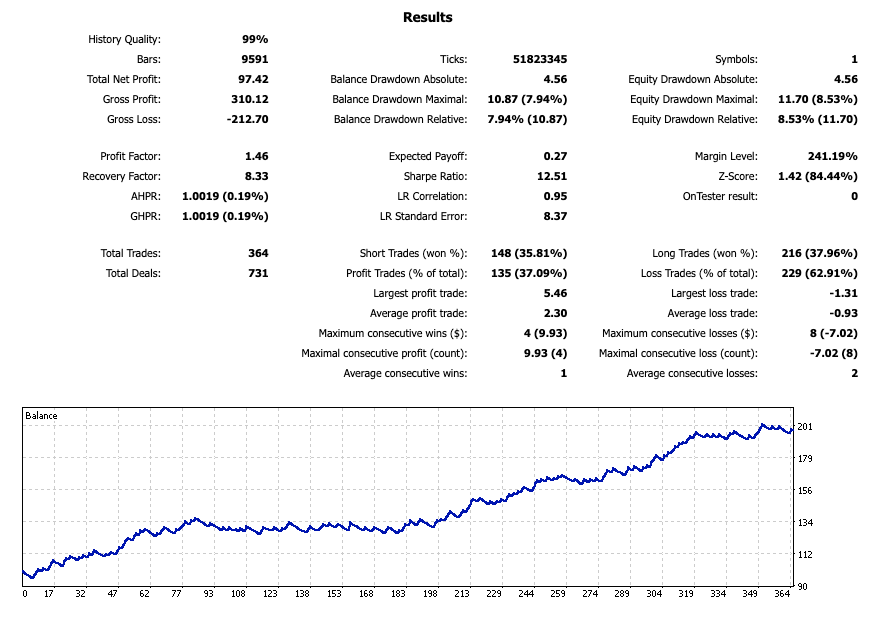

GoldStorm EA is an MT5 Expert Advisor designed to operate, with a targeted focus on trading gold (XAUUSD). It employs a blend of advanced fractal based breakout strategies and technical algorithms with a multi-strategy architecture to address a range of market conditions. While it does not take a high volume of trades, its underlying framework aims for precision and efficient risk controls.

This MT5 Expert Advisor integrates a trifecta of strategies each tailored to different trading styles and timeframes:

- Strategy A (Conservative Swing) – aims at long term setups on the 4-hour and 1-hour charts. It focuses on stable environments with a 2.5:1 risk-reward ratio, targeting higher probability trades.

- Strategy B (Aggressive Momentum) – is configured for situations with more volatility. Using 1-hour and 30-minute charts, it attempts to capture fast price movements through breakout trading, coupled with a 3:1 risk-reward profile.

- Strategy C (Trend Following) – takes a macro style approach, analyzing daily charts for broader trends, with execution on 1-hour charts. Its 3.3:1 reward structure is designed around longer term holds and substantial market movements.

Each strategy is designed to function independently but shares a common risk management infrastructure.

Technical Framework of GoldStorm EA

Fractal Breakout Analysis sits at the heart of GoldStorm EA’s logic. The EA incorporates a multi timeframe detection system with adjustable parameters like bar confirmations and lookback optimizations. Entry points are fine tuned using price offsets that aim to validate the strength of a breakout before trade execution.

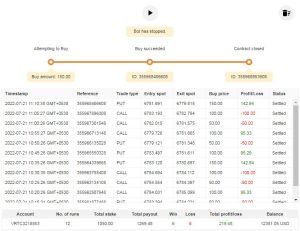

Risk Management is comprehensive, involving:

- Percentage based position sizing

- Daily limits on trade frequency

- Internal money management checks

- Risk filters for increased market protection

These mechanisms are defensive in nature and are built to minimize exposure during unpredictable conditions.

Trade Handling and Safety Nets

GoldStorm Pro employs a number of controls to manage live positions:

- Break even settings and trailing stops are utilized dynamically

- Virtual expiration timers can cancel a pending setup if market conditions shift

- Smart order tracking tries to assess trade health in real time

Through these layers, the EA attempts to mitigate risk while still maintaining open strategies.

Additional safety layers include validation checks like:

- Stop level compliance

- Lot scaling relative to account size

- Spread reactivity

- Market open/close awareness

- News event avoidance

These features provide structure and aim to keep the EA from trading under conditions it deems unstable or illiquid.

Recommendations

- Minimum Account Balance of $100.

- Designed to work on XAUUSD (GOLD).

- Work Best on H1. (Work on any Timeframe)