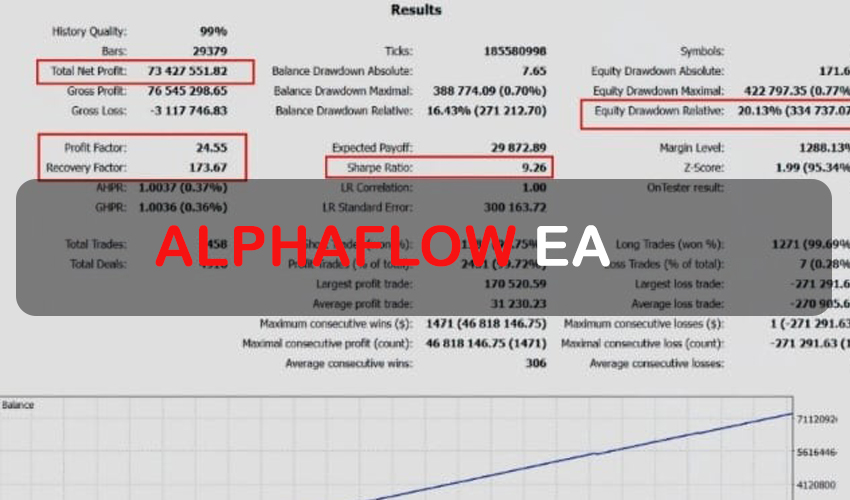

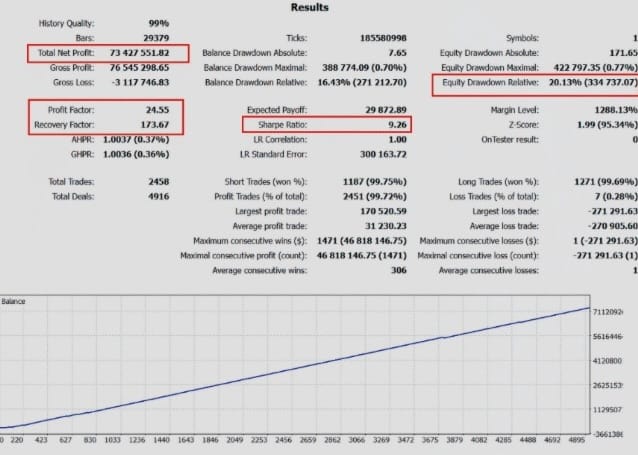

The AlphaFlow EA is presented as a sophisticated EA that aims to improve trading performance through adaptability and market analysis. It boasts a range of features designed for strategic precision and adaptability, all driven by proprietary algorithms. Let’s break down what’s being offered and consider potential caveats.

Core Features

- Sophisticated Market Analysis – The AlphaFlow EA claims to combine technical and quantitative strategies. While this sounds advanced, the specifics of these methods aren’t detailed. “Advanced pattern recognition” can be a general term and its effectiveness depends heavily on the market conditions.

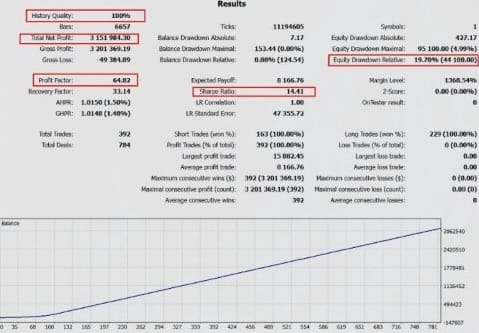

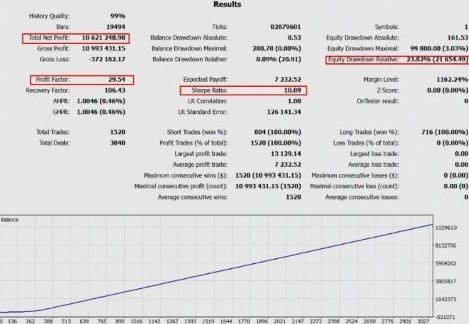

- Versatile Trading Strategies – The EA offers three pre-configured strategies, applicable to EURUSD, XAUUSD, and US500.

- Lightning-Fast Trade Execution (HFT) – The description uses “high-frequency trading” terminology. True HFT EA involves extremely rapid order placement and execution, and from testing, EA doesn’t seem to use that. I guess the execution speed is touted and attributed to “high-frequency trading (HFT) technology.

- Multi-Timeframe Analysis – Combining multiple timeframe analyses is a common practice and can improve perspective.

- Robust Risk Management – Volatility based sizing and dynamic trade management are standard risk mitigation tools.

- Algorithmic Trading Engine – The mention of statistical arbitrage, momentum, and mean reversion strategies indicates a quantitative approach. These strategies are often highly complex and require rigorous testing and parameter optimization.

- News Filter Integration – The AlphaFlow EA incorporates a news filter, designed to react to financial news releases.

- Custom Indicators – Integrates custom technical indicators, including adaptive moving averages, volatility channels, and market strength metrics.

Recommendations

- Minimum account balance of 100$.

- Works best on XAUUSD, EURUSD, and US500. (Work on any Pair)

- Works best on H1 TimeFrame. (Work on any TimeFrame)

- When backtesting, turn off “display graphical elements”