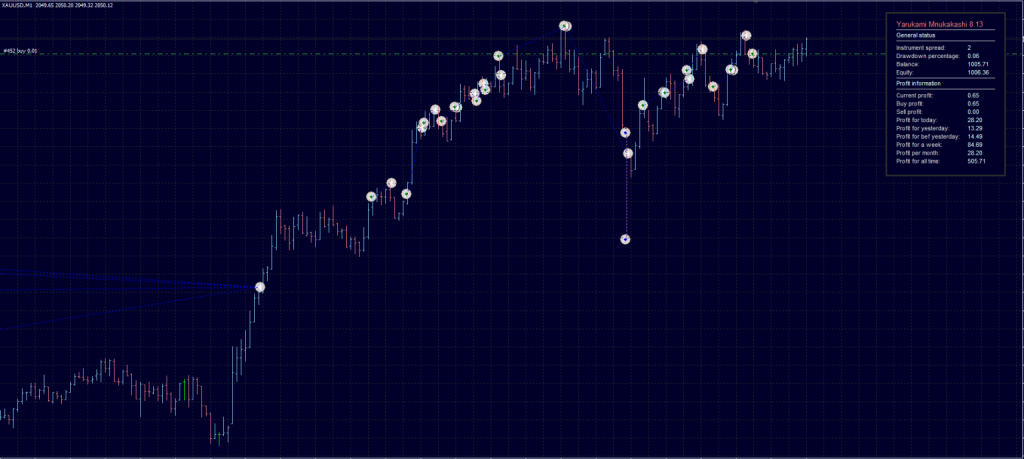

Yarukami Mnukakashi EA is an automated trading advisor developed for Forex traders. It streamlines trading by leveraging key technical indicators and customizable strategies, offering a reliable solution for traders seeking a hands-free approach to managing trades.

Key Features of Yarukami Mnukakashi EA

- Algorithm – The EA utilizes technical analysis with moving average indicators, Bollinger Bands, and Momentum indicators. These tools help analyze price movements and identify potential trading opportunities in the Forex market.

- Strategy Type – Yarukami Mnukakashi operates on a 24-hour trading cycle. However, it is recommended to avoid trading during the American session and to set a daily take-profit target of $30-40 per 0.01 lot. The EA can function in one trading direction or both simultaneously, independently of each other.

- Risk Management – The EA includes a feature to forcibly close orders at the end of the trading period by time, aiding in risk management by preventing positions from remaining open indefinitely. It employs Martingale, which can proportionally increase potential profits but may also elevate risk.

- Customizable Settings – Users have the ability to customize strategy parameters to align with their trading preferences and risk tolerance. This flexibility allows traders to adjust the EA’s behavior according to different market conditions and personal trading styles.

- Chart Style – Yarukami Mnukakashi features a distinctive chart style accompanied by an informative panel. This provides traders with clear visualizations of market data and the EA’s performance, enhancing the user experience.

Recommendations

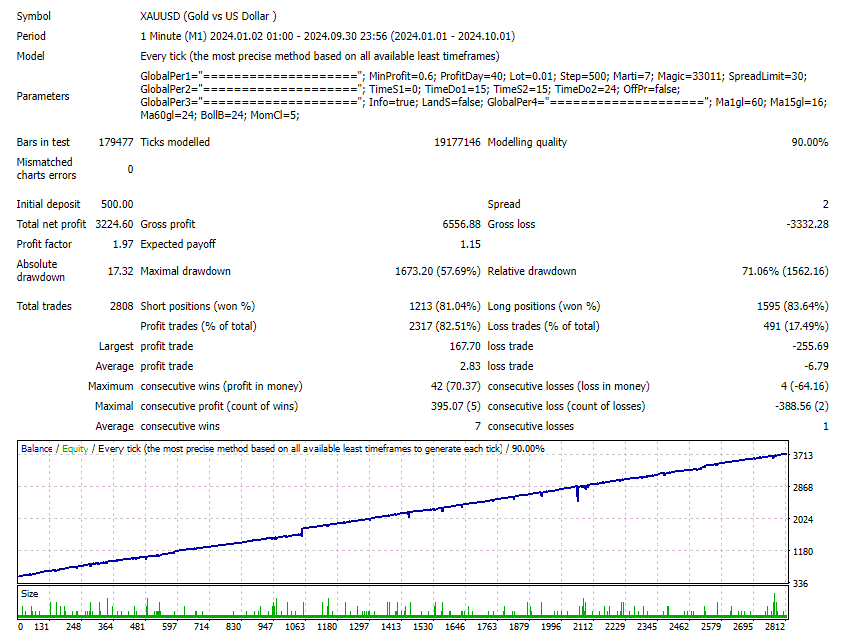

- Even though it uses the martingale from the test, it seems to work fine on a $ $500 deposit. However, I would still be cautious when using a low deposit and recommend at least a $3000$ or equivalent cent account.

- Work Best on XAUUSD(GOLD). (Work on any pair)

- Work almost the same on all TimeFrames.