Up Down EA is a fully automated robot that works based on an adaptive mechanism of volatility. This unique mechanism allows the EA to determine whether or not to place orders based on the prevailing market conditions. Consequently, there could be days without a single order or several orders within a day, making it a flexible tool in a trader’s arsenal.

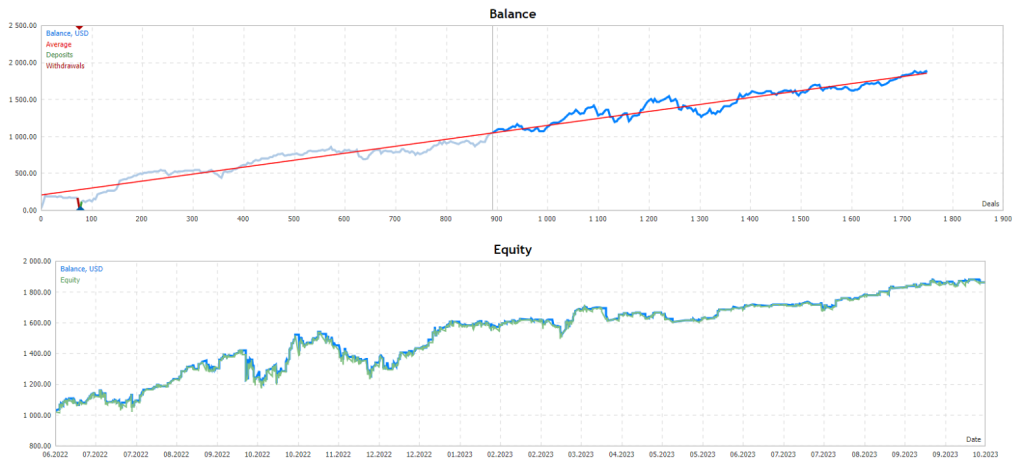

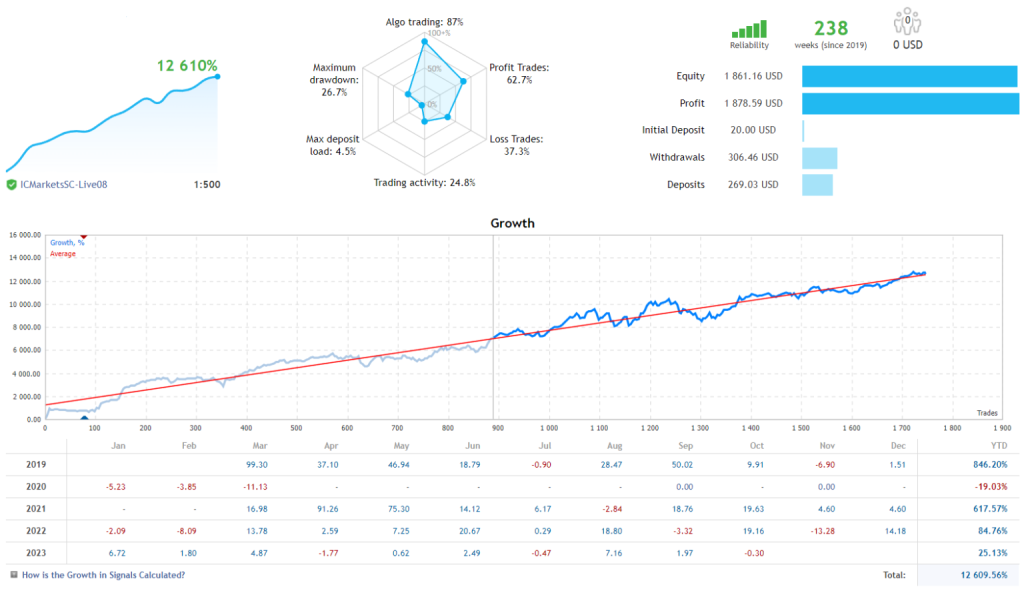

Up Down EA stands out because it’s been used in real trading for over four years, showing remarkable consistency in its performance. Unlike many EA that use a martingale or grid strategy, showing a straight-line profit curve, the Up Down EA has a fluctuating profit curve. This up-and-down movement indicates a more natural profit growth, a healthier sign of an EA’s performance. The profit curve associated with martingale or grid strategies may appear attractive, but if you are not careful, it can wipe out your account balance.

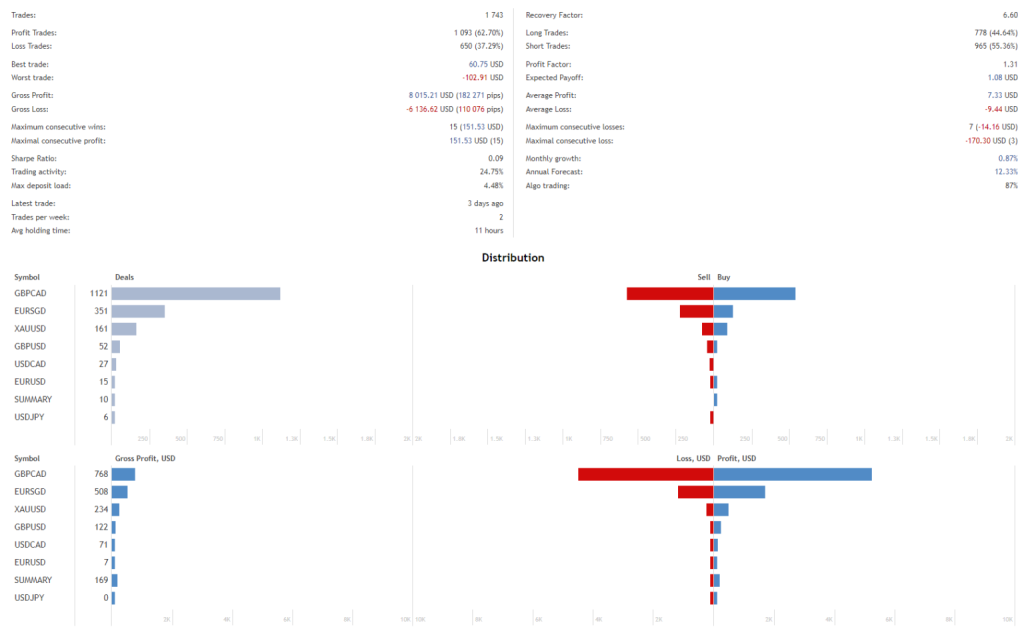

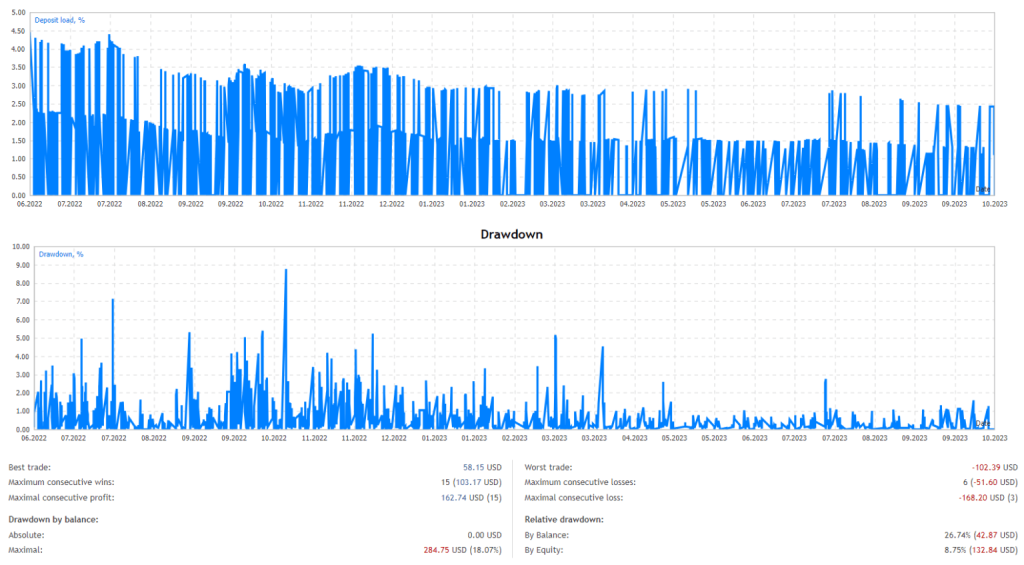

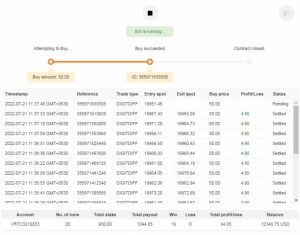

A standout feature of the Up Down EA is its prudent risk management. Even with a minimal starting amount of $20, it’s designed to safeguard your funds. It opens only one trade at a time, and each trade has a stop loss to prevent significant losses. On average, Up Down EA makes about four trades a week and doesn’t hold onto orders for more than 12 hours. This means it’s active but doesn’t take unnecessary risks by holding onto trades for too long.

Moreover, it steers clear of risky trading methods like martingale, Grid, and HFT, further underlining its commitment to maintaining a low-risk trading environment. Through these mechanisms, Up Down EA balances being active in the market and not taking unnecessary risks, epitomizing a well-rounded approach to risk management in trading.

Recommendations

- Minimum account balance of 20$.

- Work Best on GBPCAD, EURSGD, and GBPCHF. (Work on any currency pair)

- It works best on M1. (Work on any TimeFrame)