Supply and Demand EA is designed to work on supply and demand trading principles, offering a robust solution for traders of all styles. Whether you’re day trading, swing trading, or scalping, this Supply Demand Bot automates your trading decisions, allowing you to select your inputs and watch your trades execute seamlessly.

Key Features Supply and Demand EA

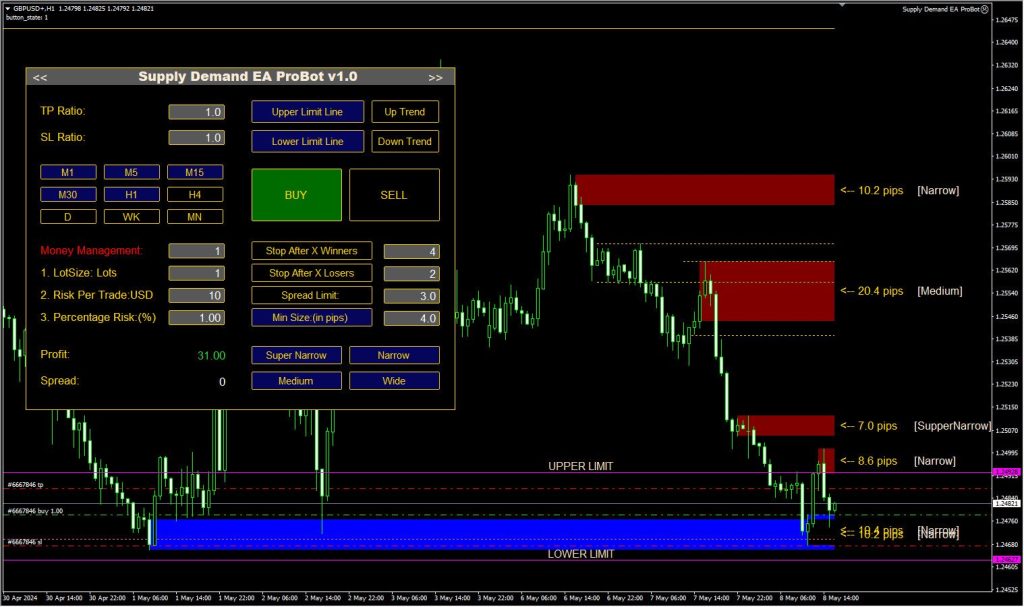

- Automatic and Manual Trading – The Supply and Demand EA places and manages trades automatically based on the zones you specify. If you prefer a hands-on approach, you can also place trades manually by clicking the zone label next to the identified zones.

- Versatile Trading Styles – You can adapt the Supply and Demand EA to your preferred trading style. Whether a day trader, swing trader, or scalper, the trading panel allows you to select the timeframes you want to trade and set your desired Take Profit (TP) and Stop Loss (SL) ratios.

- Multi-Timeframe Trading -The EA supports multi-timeframe trading, meaning you can manage trades across various timeframes from a single control point. By analyzing the 4-hour and daily timeframes for day trading or the weekly and monthly timeframes for swing trading, you can determine the trading direction and let the EA handle the rest.

Recommendations

- The exact recommended settings are unknown, but it can function for $100 and is compatible with any pair (Forex/Indice/CFD/Metal). It also operates on all timeframes.

Customizable Settings

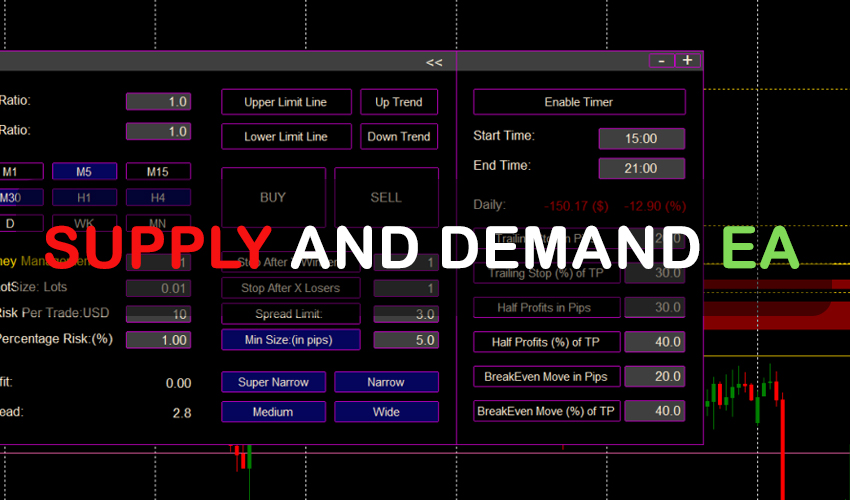

The trading panel offers extensive customization options to suit your trading preferences:

- Trading Direction – Choose to trade either in the Buy or Sell direction.

- Timeframes – Select the timeframes on which you want to place trades.

- Zone Types – Trade different types of zones (Wide, Medium, Narrow, SuperNarrow).

- Money Management – Select from three different money management options.

- Trade Limits – Set limits on the number of profit or losing trades after which the EA will stop trading.

- Risk Management – Choose between risk-based or ATR-based TP and SL ratios.

- Trading Channels – Define zones within a Bullish or Bearish channel.

- Price Range – Set an upper and lower limit for the price range.

- Time Range – Specify the hours during which you want to place trades.

- Additional Functions – Utilize various trailing stop loss, half profits, and break-even functions.