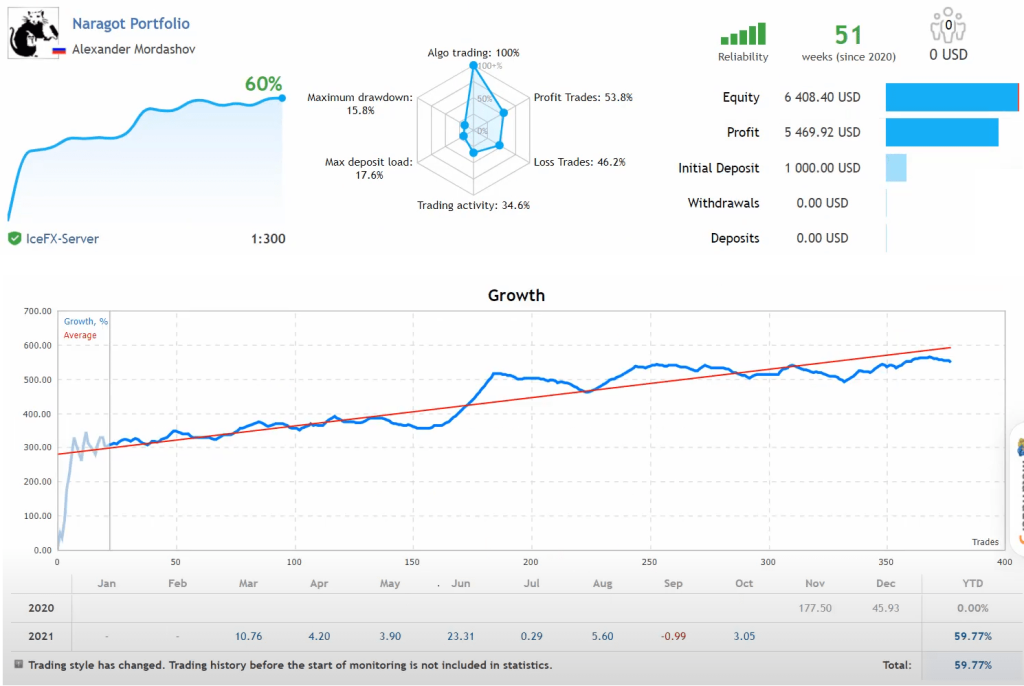

Naragot Portfolio EA is a fully automated MT4 Multi-Currency EA that is FREE to Download. It is a trend-following multicurrency trading system engineered based on the principles of volatility breakouts and breakouts of support and resistance levels. The EA boasts seven diverse strategies chosen from a broader pool of successful strategies.

This article aims to provide a detailed and in-depth understanding of this EA, which has emerged as a reliable tool for professional forex traders.

One thing that sets the Naragot Portfolio EA apart from many other EAs is its unique approach to trading. This EA doesn’t promise trades every day or profits every week. Instead, it trades like most professionals do: with rare but accurate entries. It capitalizes on large trending movements that do not occur daily. When these trends appear, the EA is designed to utilize them to the fullest extent possible.

Contrary to some systems based on curve fitting, tester grails, or over-optimized indicators parameters, the MT4 Multi-Currency EA is rooted in fundamental principles that work on various popular trading instruments.

Trading Principles of Naragot Portfolio

“Trend is your friend,” a popular trading adage, is the guiding principle of the Naragot Portfolio EA. This system is designed to only trade in the direction of trends. It employs two completely different types of trend trading for better coverage and effectiveness.

Interestingly, the MT4 Multi-Currency EA doesn’t rely on any indicators. It adopts a Pure Price Action approach, emphasizing the market’s raw data.

The EA focuses on four of the most liquid pairs in the forex market: EURUSD, GBPUSD, XAUUSD, and USDJPY. These pairs generally have the lowest spreads and the highest liquidity, making them ideal for trading.

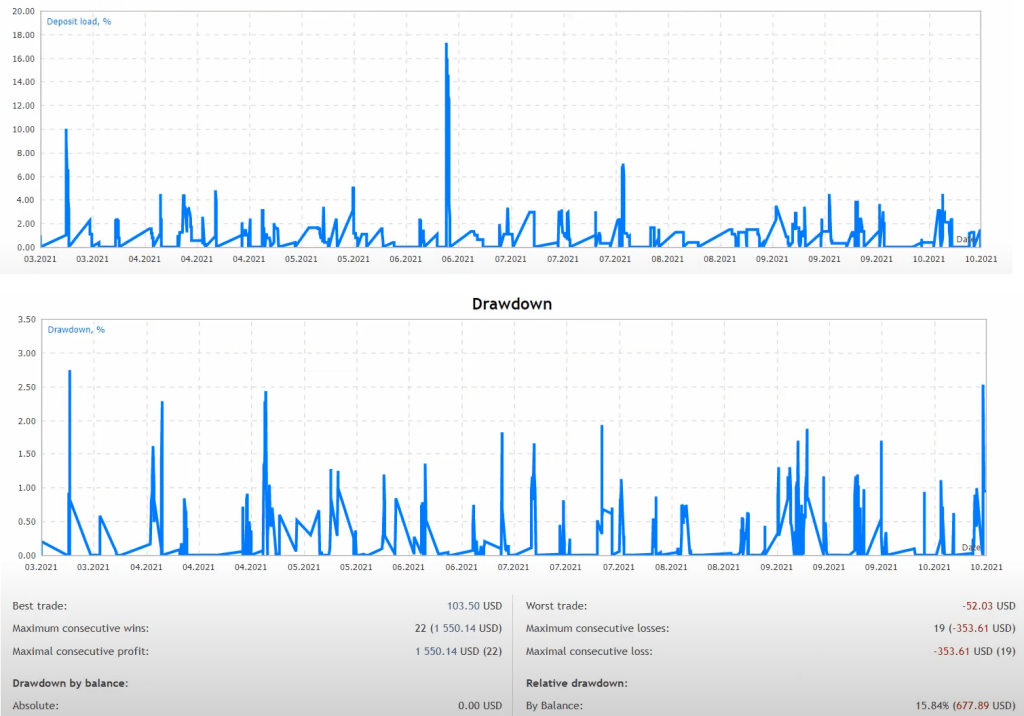

Risk Management

Every position initiated by the Naragot Portfolio EA has its predefined Take Profit (TP) and Stop Loss (SL) levels. These levels remain unchanged until the position closes. Notably, the TP is always higher or equal to the SL, a crucial factor in maintaining the system’s robustness.

The EA also doesn’t use toxic money management methods like grid, martingale, curve fitting, artificial high win rates, or scenarios where Stop Loss is greater than Take Profit. These methods often lead to a loss of deposits, undermining the trader’s overall profitability.

Recommendations

- Minimum Account Balance of 1000$.

- This EA is one chart setup, so it’s only needed to attach on one pair(preferably EURUSD). It will trade on all pairs described on the input parameter.

- Work Best on M1.

- MT4 cannot perform multi-currency backtests, So when you backtest this EA, you only get the result of the only pair you tested.