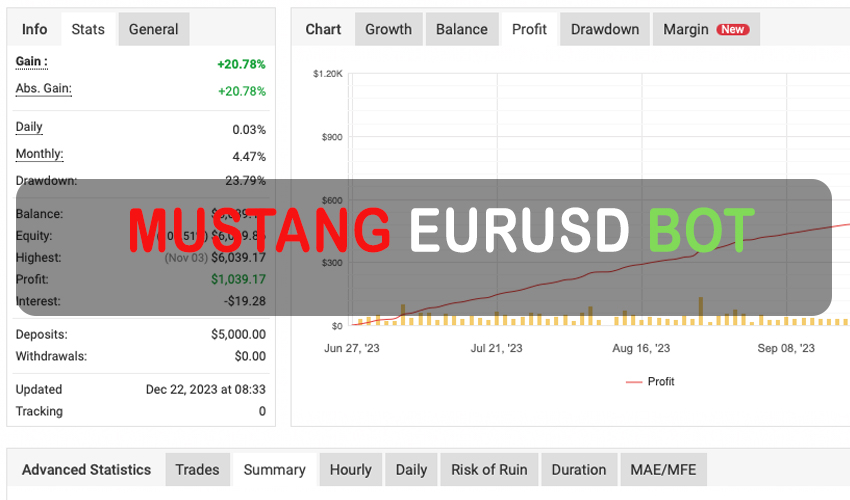

The Mustang EA positions itself as an automated hedging solution, targeting traders of all experience levels. This EURUSD Bot centers around a breakout strategy designed to operate effectively during periods of price consolidation. A key claim is its reliance on bar close data for entries and exits, aiming to reduce the impact of market volatility.

Mustang EA Features

Here’s a breakdown of Mustang EA features, presented without hyperbole:

- Strategy Focus – The EURUSD EA’s primary strength is reportedly finding opportunities in consolidating markets using a breakout approach.

- Execution Method – Utilizing bar close data for decisions minimizes potential whipsaws but inherently lags market movement.

- Pair & Timeframe – Optimized for EURUSD on the H1 timeframe, limiting its usability on other pairs or timeframes

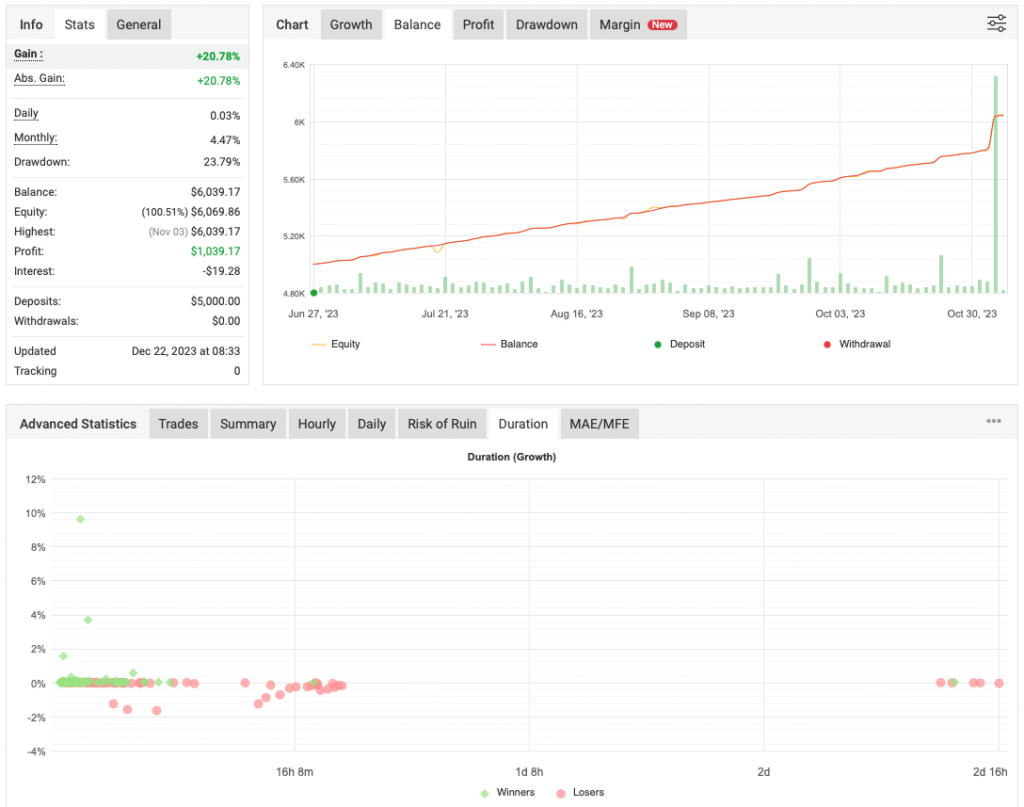

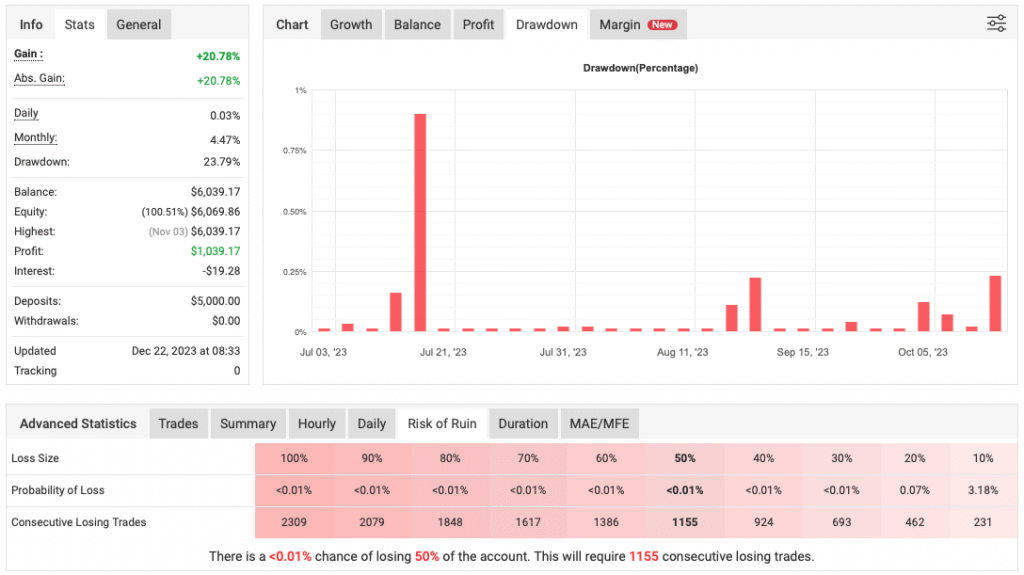

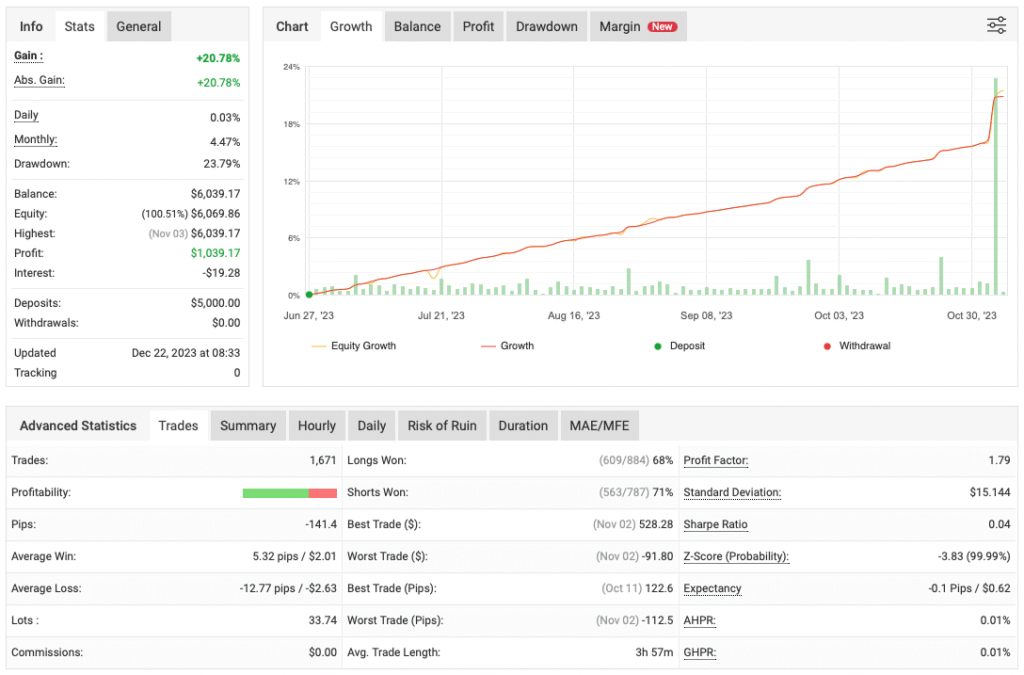

- Risk Management – Includes standard features like spread filters, equity stops, and drawdown protection, common in automated trading systems.

- Money Management – Offers flexible lot sizing options, though the effectiveness depends heavily on market conditions and user parameter choices.

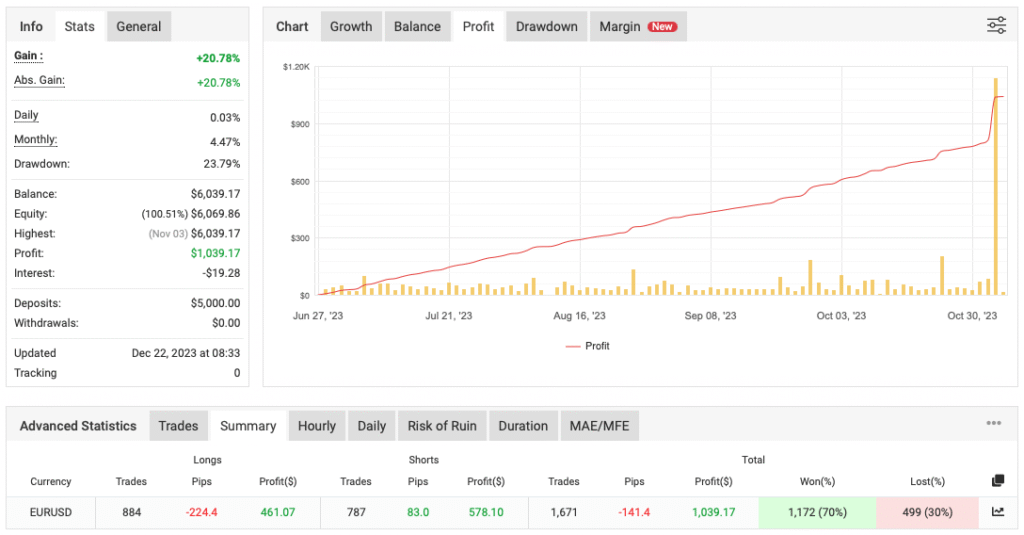

- Avoidance of Strategies – Specifically avoids potentially high-risk strategies like grid trading, martingale, and arbitrage. This limits its potential for rapid gains but could also reduce risk.

- Non-Curve Fitting – Claims to avoid overfitting, which suggests a focus on adaptability.

Recommendations

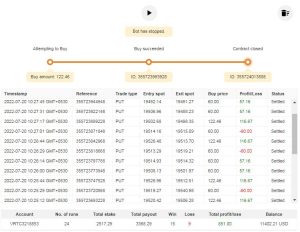

- Minimum account balance of 500$.

- Works best on EURUSD. (Work on any Pair)

- It works best on H1. (Work on any TimeFrame)