HiJack EA promising significant profitability through fast scalping. Fast Scalper EA marketing materials highlight its use of “cutting-edge artificial intelligence” to mimic the trading strategies of major financial institutions, achieving “maximum speed, optimal profit potential, and minimal risk.” Let’s break down the advertised features and observed behaviors.

Advertised Features & Claims of HiJack EA

- Institutional Order Tracking – The EA purportedly identifies and capitalizes on large-scale buy and sell orders executed by major banks and institutions.

- Risk Management – The system avoids common high risk strategies like Martingale, utilizing a fixed 30 pip stop loss.

- Automated Lot Sizing – The EA automatically calculates the lot size for each trade.

- Dynamic Take Profit – Take profit levels are adjusted automatically for quicker gains.

- Daily Profit Target – Traders can define a target daily profit.

Proceed with Caution

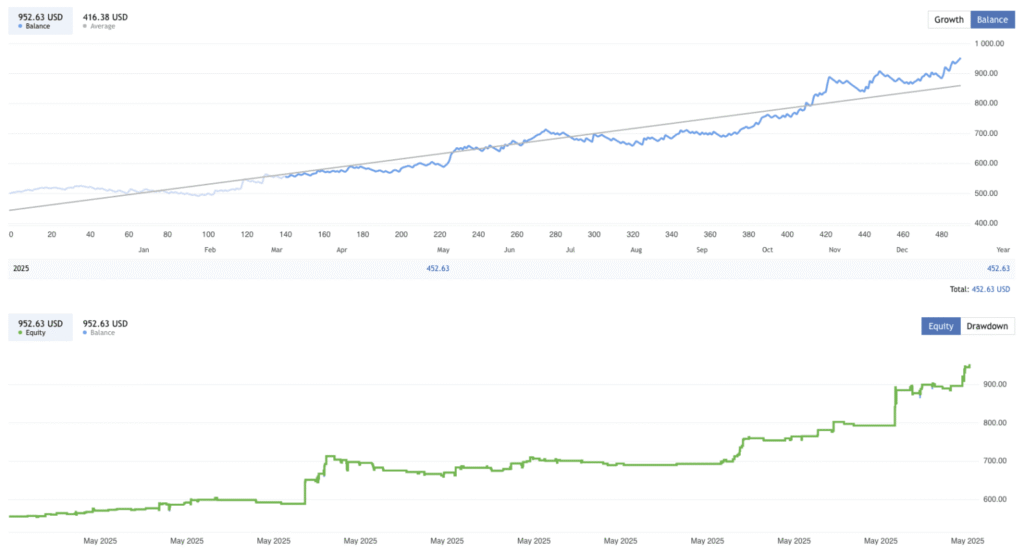

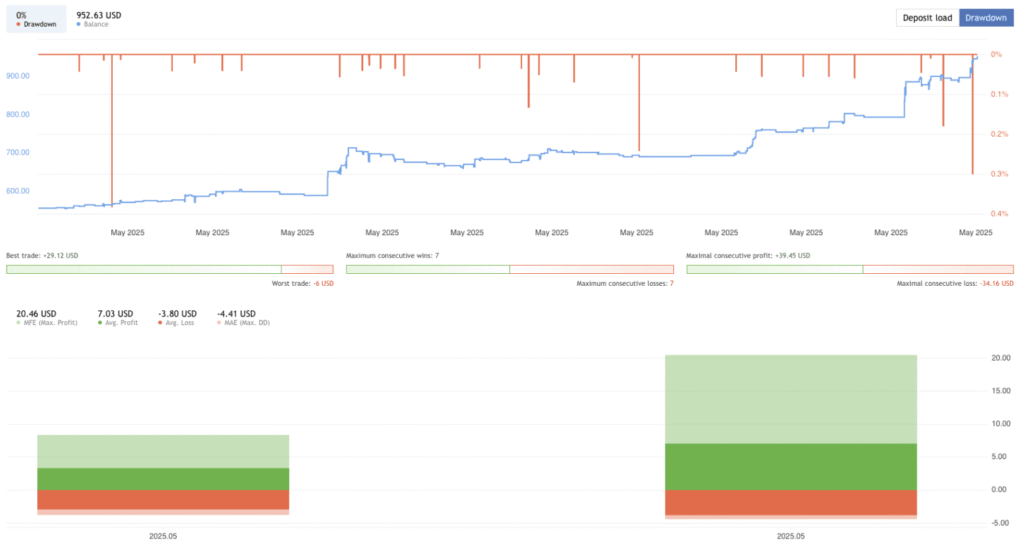

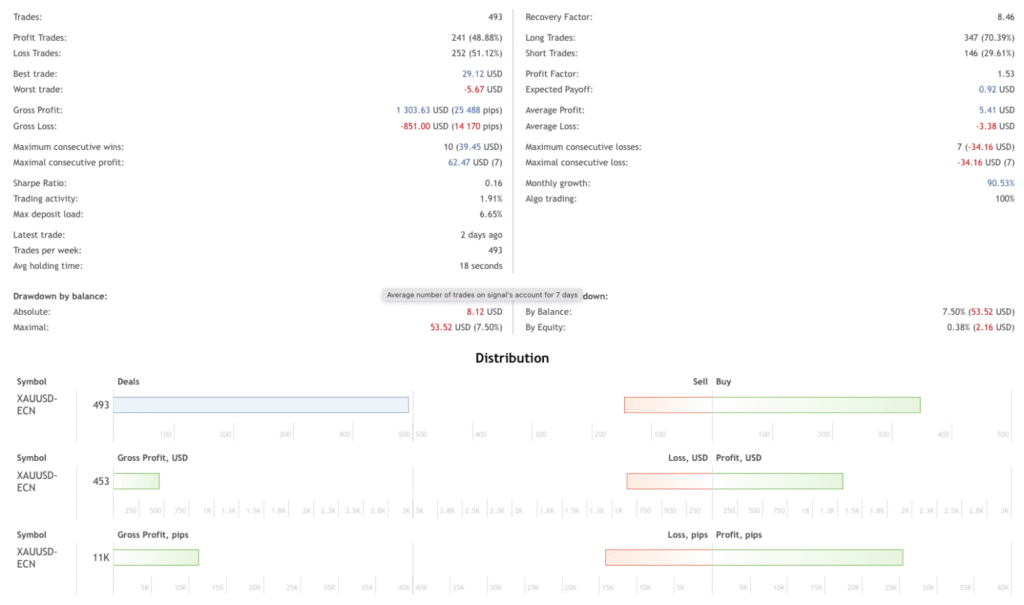

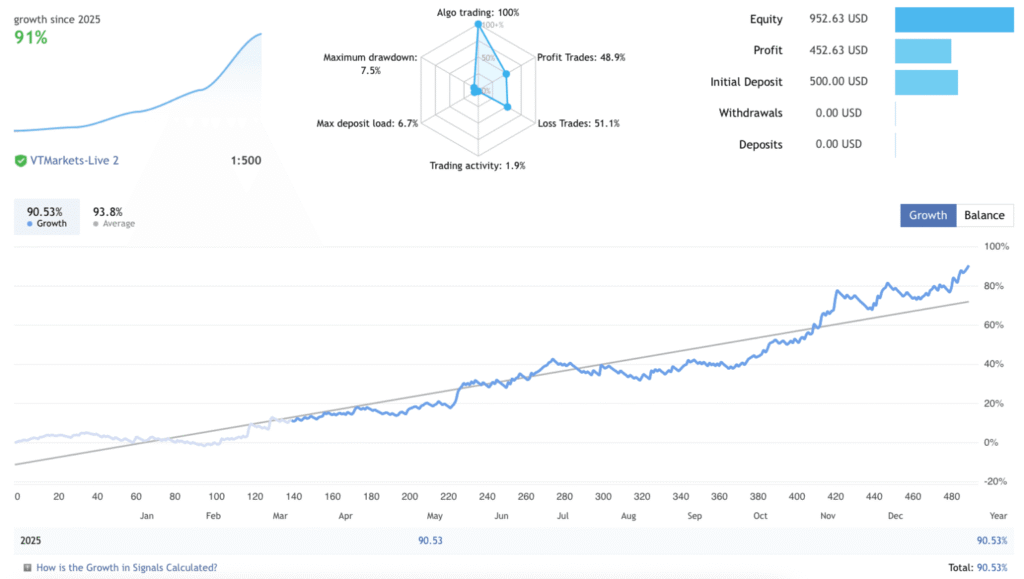

Testing suggests the HiJack EA operates as a fast scalper EA, primarily active during periods of high market volatility. Trades are frequently opened and closed within seconds, often coinciding with market reactions to significant events or news releases. Achieving results mirroring backtest performance will likely be challenging.

- Volatility Dependence – The EA’s performance appears strongly correlated with market volatility.

- Latency Requirements – The speed of execution suggests a significant need for low-latency. A VPS with minimal latency is likely essential for optimal performance.

- Spread Sensitivity – A low spread account will likely be necessary to minimize trading costs and improve profitability.

- AI Claims Unsubstantiated – While marketed as utilizing “cutting-edge artificial intelligence,” there is currently no publicly available evidence to support this claim. The algorithms employed remain opaque.

Recommendations

- Minimum account balance of 100$.

- Works best on XAUUSD and EURUSD. (Work on any Pair)

- It works best on M1 and M5. (Work on any TimeFrame)