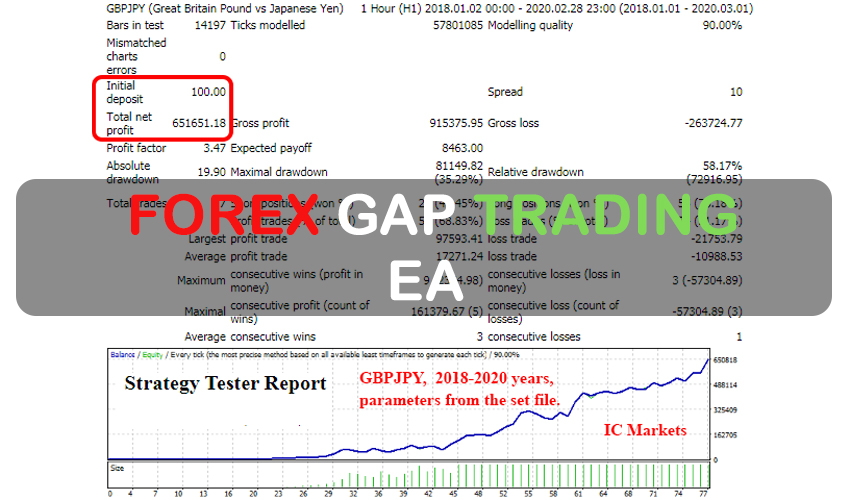

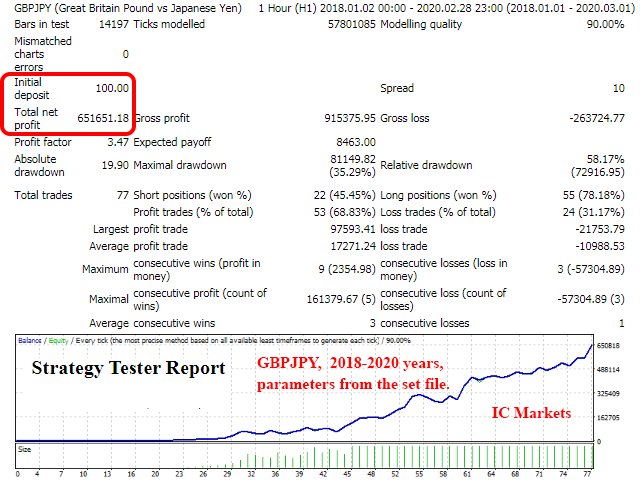

The Forex Gap Trading EA is a trading tool designed to capitalize on the natural tendency for prices to return to their original value after a gap. Gap EA is designed to capitalize on this market characteristic. It identifies the occurrence of gaps, measures their magnitude, and decides whether to enter the market based on the price’s behavior toward closing the gap.

Key Features of Gap EA

- Market Analysis and Entry – The Gap EA analyzes price movements using a tick criterion, enabling it to accurately determine movement onset towards gap closure. This criterion minimizes latency, allowing the EA to efficiently utilize price movements for profit.

- Position Management – The EA includes various trailing methods to manage open positions, which helps reduce trading risks. This feature ensures that the positions are monitored and adjusted as needed to maximize returns while minimizing potential losses.

- Automatic Money Management – The EA adjusts transaction lot sizes according to accumulated volumes, facilitating the reinvestment of profits. This adaptive approach enhances the safety and efficiency of the EA’s operations.

- Protection Mechanisms – Equipped with multiple protections and interlocks, the EA is designed to operate stably even in adverse market conditions. This robust design helps safeguard the trading account from unexpected market fluctuations.

- Trading Frequency and Accuracy – Gaps are relatively rare, so the Gap EA does not frequently open positions. However, when it does, the transactions are highly accurate and typically involve increased volume, which enhances trading efficiency.

Recommendations

- Minimum account balance of 50$.

- It works best on GBPJPY. (Work on any currency pair)

- It works best on the H1 TimeFrame. (Work on any TimeFrame)