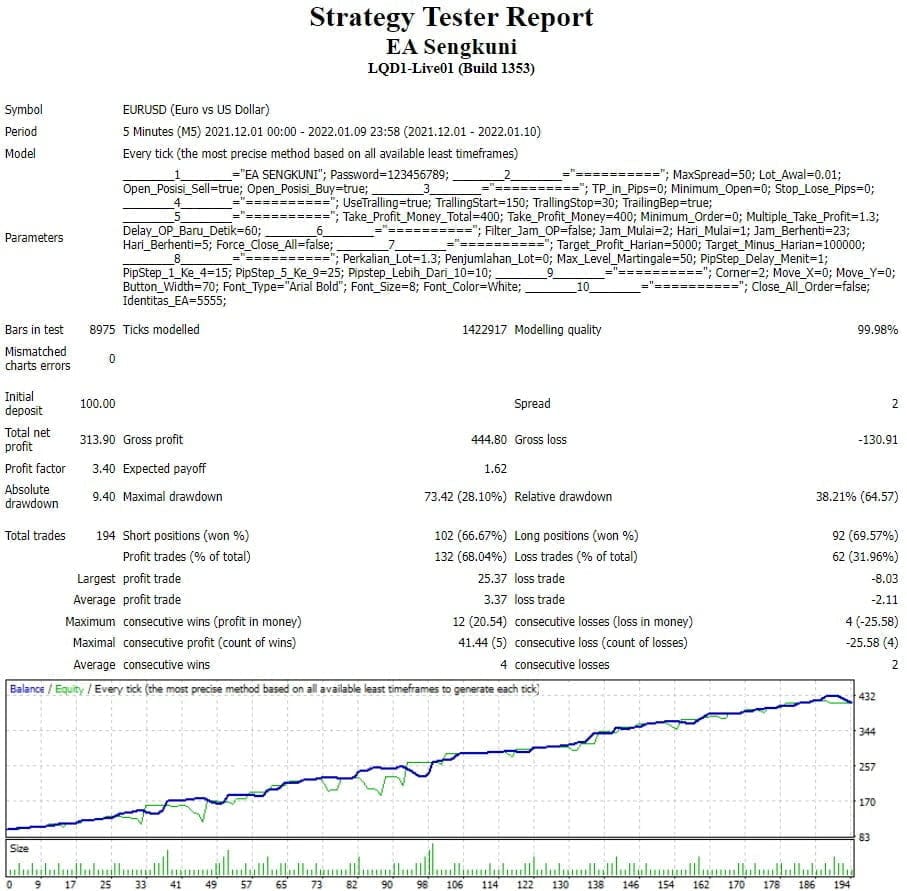

Sengkuni MT4 EA is a type of automated trading software designed for the MetaTrader 4 platform. Like many other Expert Advisors, it operates by following a predefined strategy. In this case, a combination of martingale and hedging techniques. This particular combination can be powerful in certain market conditions, though it comes with both potential advantages and disadvantages that traders should consider objectively.

Understanding the Strategy of EA Sengkuni

The martingale strategy is well-known in both gambling and trading circles. It essentially involves doubling down on losing positions in the hope that a future win will recover all prior losses plus gain a profit. Meanwhile, hedging is a more risk-averse tactic where a trader opens offsetting positions in different directions to cushion against possible losses.

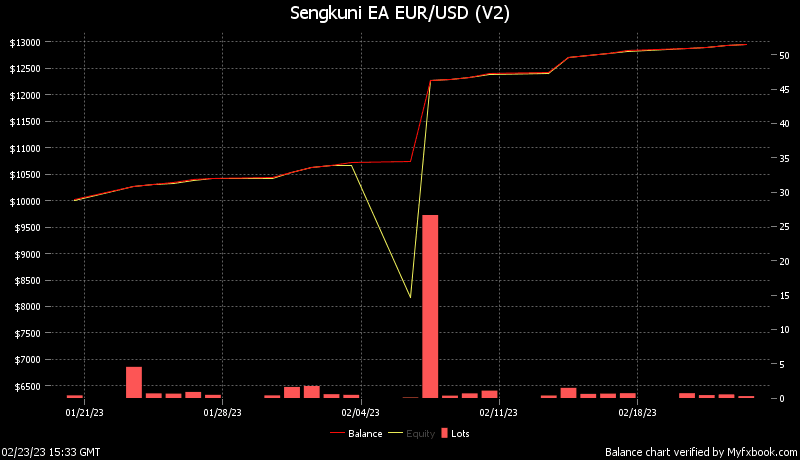

Sengkuni MT4 EA leverages both strategies simultaneously. According to the developers, this structure allows the EA to achieve a very high Return on Investment (ROI) with moderate to reasonable stability. It has been promoted as an advanced trading system that can supposedly “perform miracles,” although it’s important to note that every trading method, particularly those involving martingale, comes with serious risk factors.

Caution Surrounding Martingale

Many traders are cautious about martingale strategies. The mechanism relies heavily on the assumption that the market will eventually reverse and move in a favorable direction. While this may happen often enough to produce temporary gains, continued use in volatile or trending market conditions can lead to significant drawdowns or even account wipeout if not managed properly.

Sengkuni attempts to mitigate some of this risk by integrating hedging, which provides a counterbalance by opening trades in the opposite direction. This aspect may help stabilize the system under certain circumstances, but does not entirely remove the financial exposure that martingale inherently carries.

Recommendations

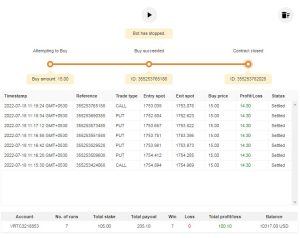

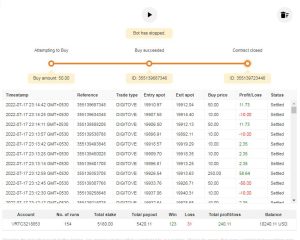

- Minimum Account balance of 100$ or 100$ cent account for safer setting, Recommend adapting your own risk level and deposit since EA can double 100$ Account in 2 weeks with a chance to blow the account too. (But it can be mostly avoided if you can turn off the EA and close all trades on volatile markets or News)

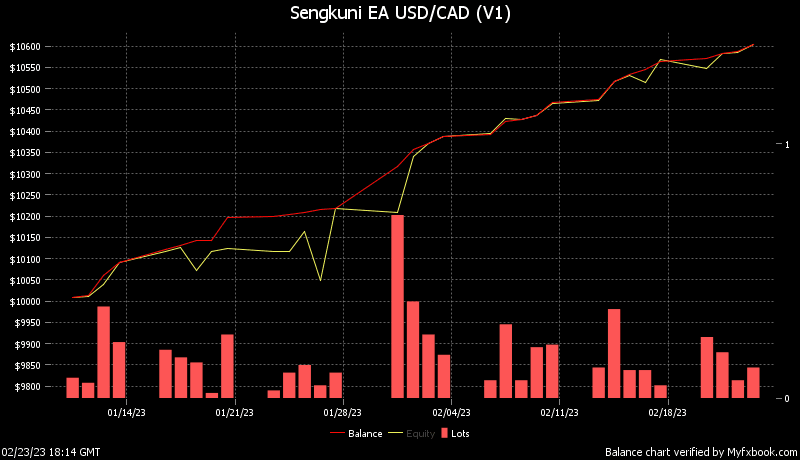

- Work Best on EURUSD and USDCAD. (Work on any currency pair)

- Work the same on all timeframes.