Trading in gold, one of the most volatile and challenging financial instruments, requires precision, adaptability, and strong risk management. CyNera EA markets itself as a cutting-edge solution, promising to combine advanced strategies, artificial intelligence, and rigorous testing to deliver optimal results in gold trading. But how does this EA hold up under scrutiny? Let’s dive deeper into its claims and potential pitfalls.

Seller’s Claims – An Advanced, AI-Powered Trading Solution

According to the seller, CyNera MT4 EA integrates state-of-the-art neural network technologies and AI-driven strategies to analyze and adapt to market conditions. Its features include:

- AI-Driven Decision Making – Utilizes neural networks, including neuroevolutionary and Echo State Networks (ESN), to predict price movements and optimize trading strategies.

- Transformer Networks – Claims to analyze market sentiment by processing external factors such as news and economic reports.

- Generative Adversarial Networks (GANs) – Simulates extreme market scenarios to test and improve strategy resilience.

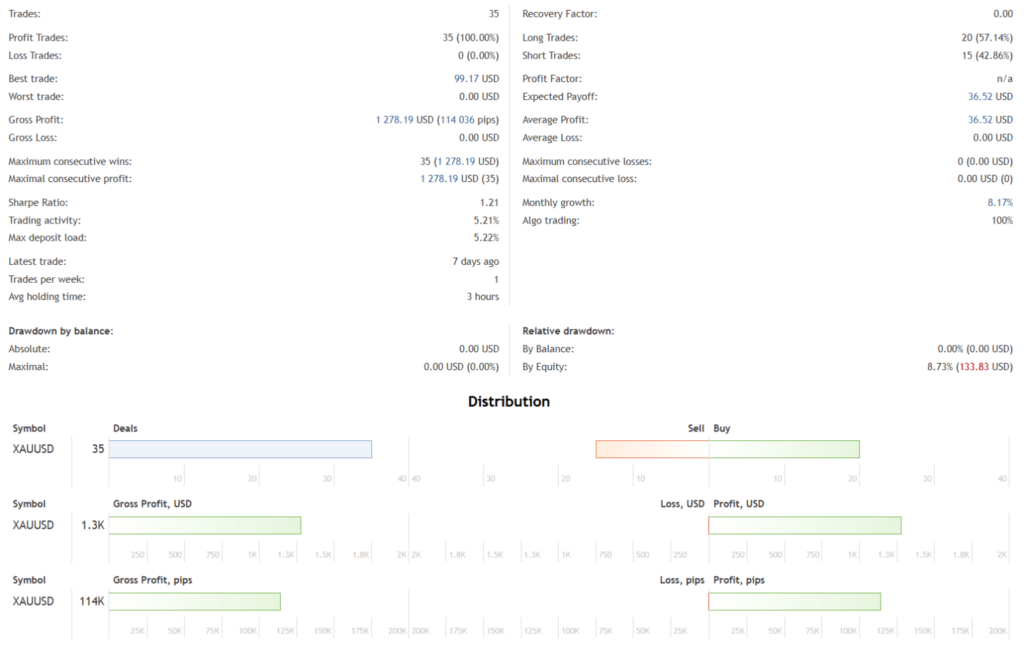

- Dynamic Trading Frequency – Adjusts the number of trades based on market volatility.

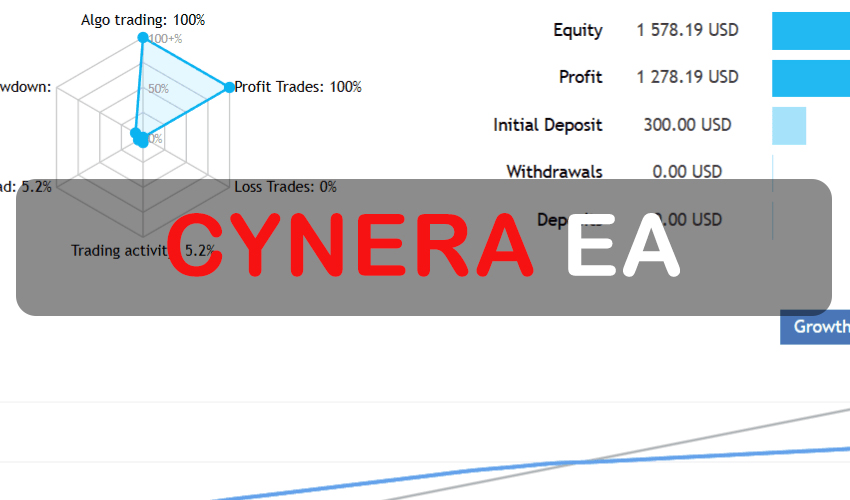

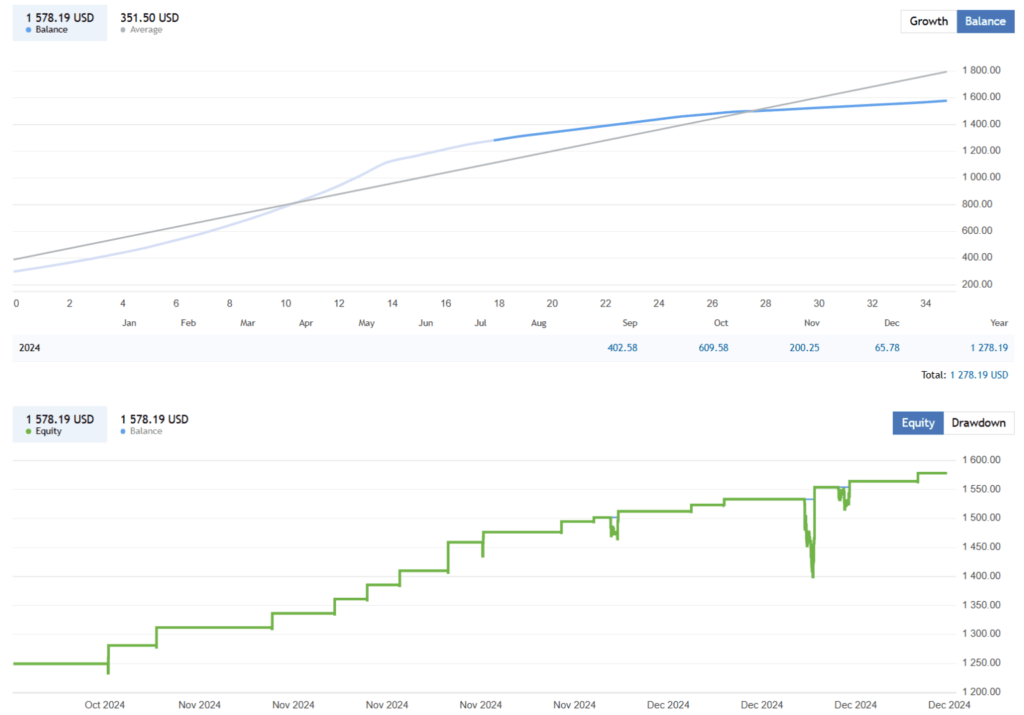

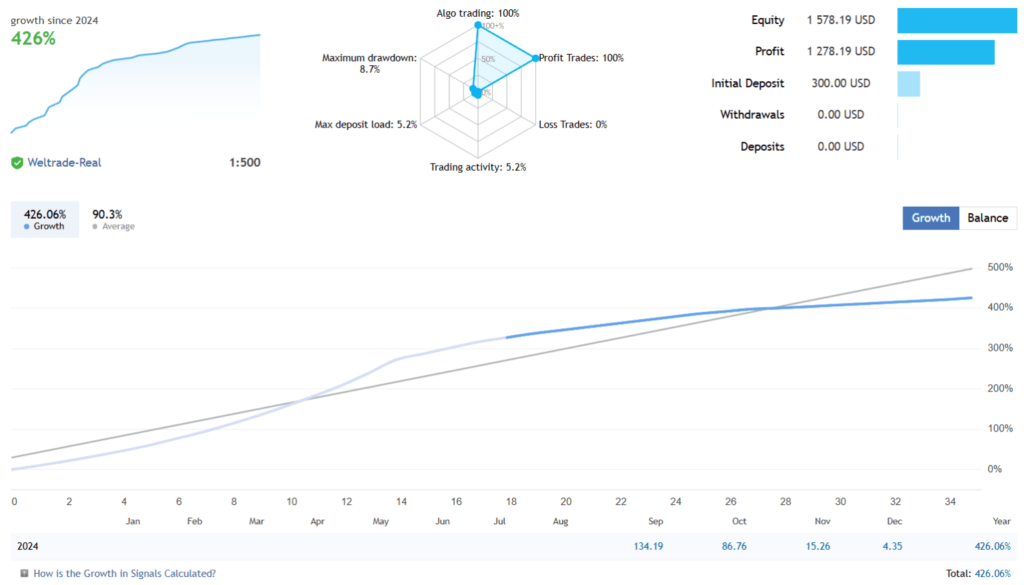

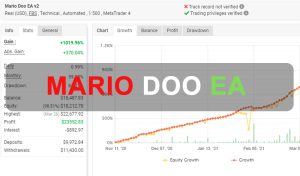

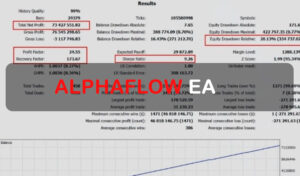

- Proven Performance – Boasts over a decade of backtesting, showing consistent profitability and controlled drawdowns.

- User-Friendly Design – Offers optimized default settings for beginners and customizable options for experienced traders.

Recommendations

- Minimum account balance of 100$.

- Works best on GOLD. (Work on any Pair)

- Work best on M30 TimeFrame. (Work on any TimeFrame)