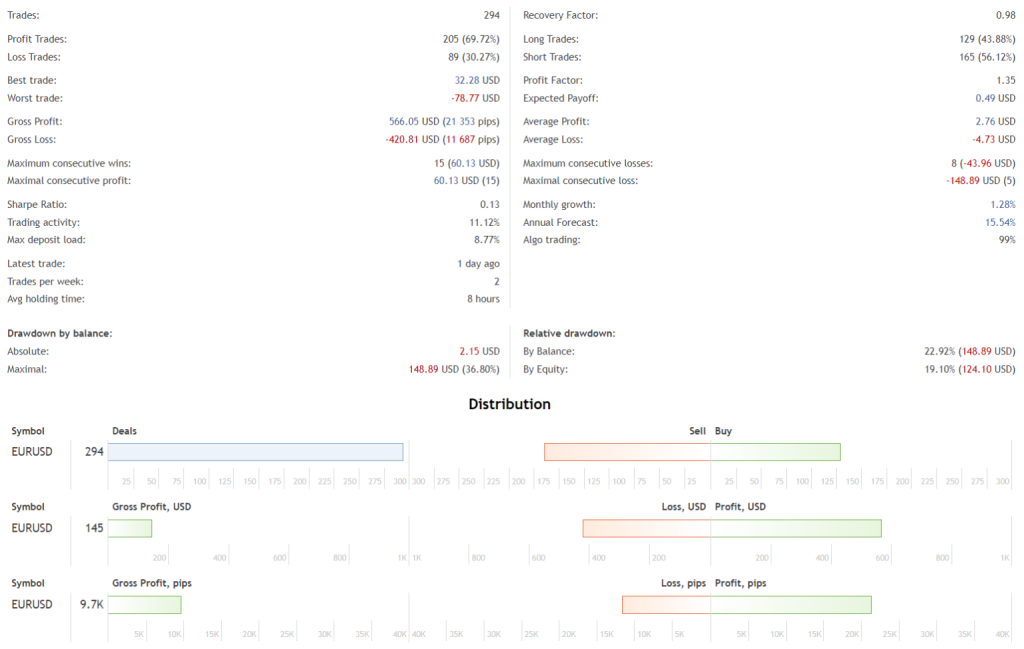

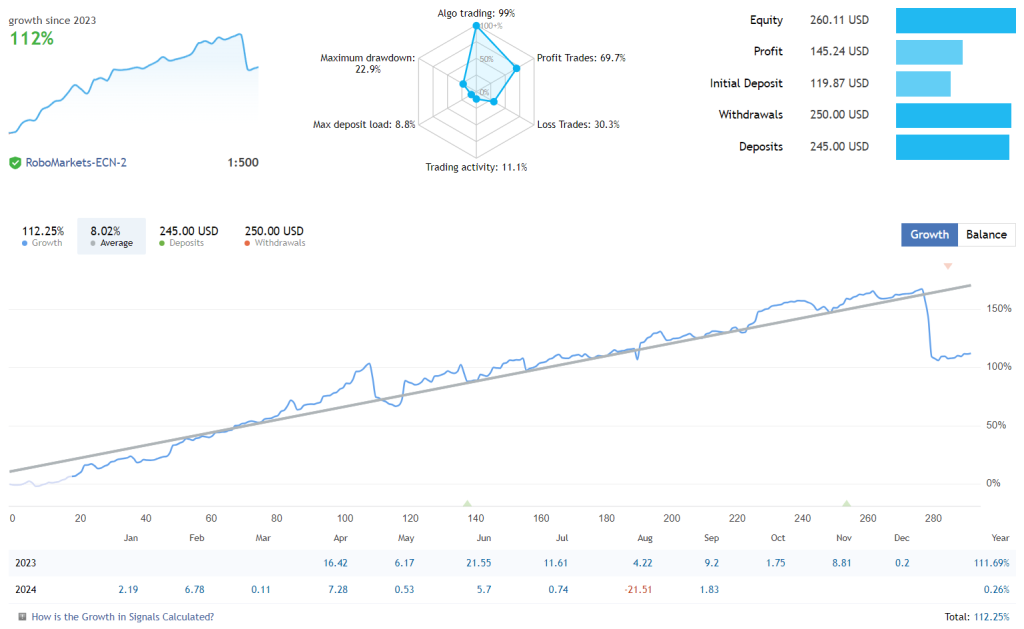

Equilibrium Trader EA is an algorithmic trading tool designed to capitalize on price imbalances in the financial markets. Based on the concept of mean reversion, Sorgo EA aims to exploit scenarios where prices deviate from their average values, anticipating a return to equilibrium. It operates under standard market conditions without employing high-risk strategies, offering traders a balanced approach to automated trading.

Key Features

- Built-in News Filter – The EA includes a customizable news filter that allows traders to adjust settings based on upcoming economic events. This feature helps mitigate market volatility risks during significant news releases.

- Robust Risk Management – Every trade initiated by the EA is protected by a stop-loss (SL) order. It avoids accumulating losses for the sake of producing visually appealing profit charts, thereby not relying on the hope of market recovery to offset losses.

- Standard Trading Conditions – Equilibrium Trader EA does not depend on specific trading conditions such as tight spreads, low slippage, or particular trading levels. This flexibility enables it to function effectively across various brokers and market environments.

- Customizable Risk and Return Profile – Traders can adjust settings to align with their risk tolerance and return expectations. This adaptability allows users to select their preferred trading patterns and strategies.

How Equilibrium Trader Works

Equilibrium Trader EA opens positions with one to three orders, depending on the configured settings. Current market conditions dynamically determine the spacing between these orders, resulting in varying distances for each position. Key aspects of its operation include:

- Automatic SL and TP Calculation – Stop-loss (SL) and take-profit (TP) levels are automatically calculated based on specific market parameters at the time of order placement. This ensures that each trade has predefined risk and reward levels.

- pattern-Based Position Closure – Positions are closed not merely when they reach a certain profit or loss threshold but when a specific market pattern emerges that signals an optimal exit point. This approach focuses on strategic exits rather than reactive ones.

- Avoidance of High-Risk Methods – The EA does not utilize grid trading, martingale strategies, or averaging techniques. Steering clear of these high-risk methods reduces the potential for significant drawdowns and promotes sustainable trading performance.

Recommendations

- Minimum Account Balance of $100.

- Work Only on EURUSD. (Work on any pair)

- It works best on the M15 time frame. (Work on any time frame)