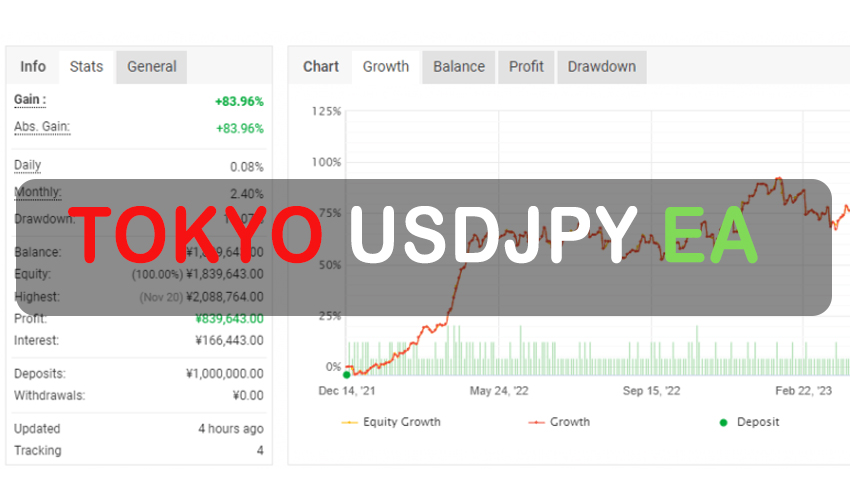

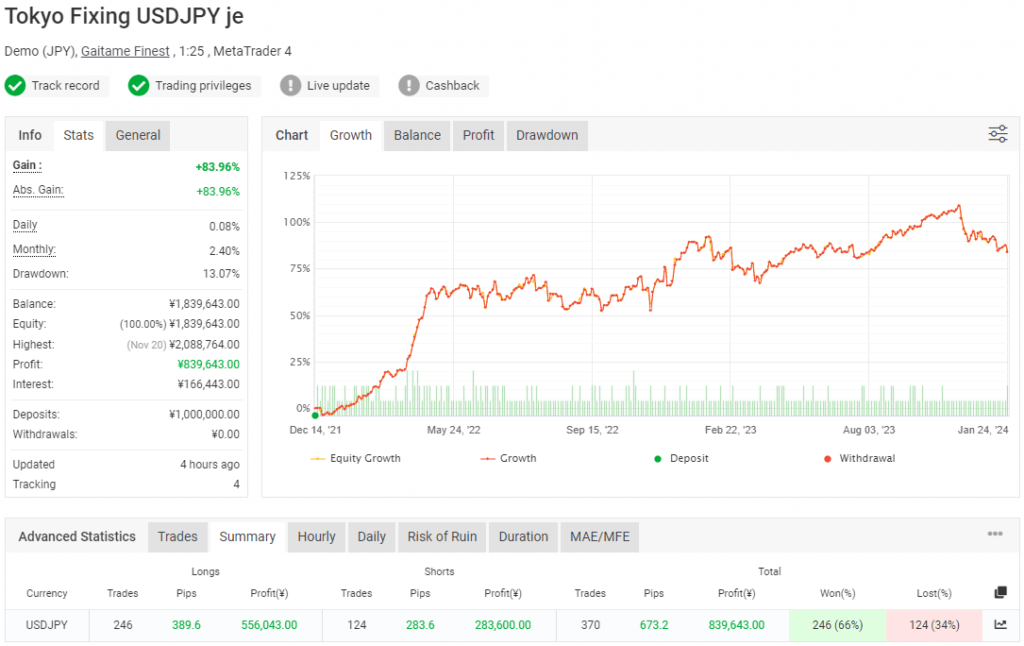

Introduction to Tokyo USDJPY EA

In the world of Forex trading, the Tokyo USDJPY EA stands out as a specialized Expert Advisor (EA) crafted specifically for trading the USDJPY currency pair. This advanced EA utilizes the Relative Strength Index (RSI), a momentum oscillator that effectively measures the speed and change of price movements, to optimize trade entry points. By focusing on specific time windows, the Tokyo USDJPY EA ensures that trades are executed when market dynamics are most favorable, particularly during the opening hours of the Tokyo market.

Optimized Trading Hours for Maximum Efficiency

The Tokyo USDJPY EA operates on a carefully selected timetable to capitalize on market potential. Buy orders are strategically placed from midnight to the early morning hours, Japan time, aligning with the start of the Tokyo market session. These orders are subsequently closed by 9:55 AM Japan time. For those targeting bearish trends, Sell orders are executed precisely at 9:55 AM. This timing-focused strategy leverages historical patterns and volatility, making trading more predictable and potentially more profitable during these peak hours.

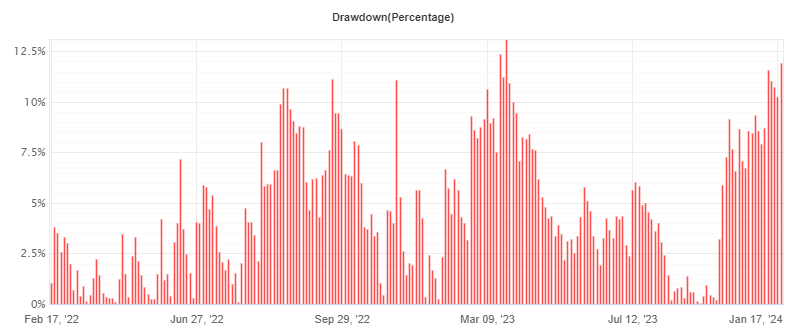

Risk Management and Trading Safety

Risk management is a pivotal aspect of successful trading, and the Tokyo USDJPY EA is built to prioritize safety and effectiveness. Contrary to high-risk strategies like Martingale, this EA maintains a conservative approach by executing one trade at a time. This policy not only keeps the trading activity manageable but also minimizes potential overleveraging, thereby enhancing the safety of investments.

Smart Profit and Loss Protection

Each trade initiated by the Tokyo USDJPY EA is safeguarded with a Take Profit (TP) and a Stop Loss (SL) mechanism. While the initial settings are at 100 pips, the EA smartly adjusts these to more practical averages—approximately 10 pips for TP and 9 pips for SL. This refined strategy not only secures investments but also aligns with the volatile nature of the Forex market, ensuring that traders can capitalize on quick market movements without incurring significant risks.

Key Recommendations for Using Tokyo USDJPY EA

To maximize the effectiveness of the Tokyo USDJPY EA, it is recommended to maintain a minimum account balance of $100 for trading 0.01 lots. Although it is specifically optimized for the USDJPY currency pair, its versatile design allows it to function effectively across various pairs and timeframes, with optimal performance observed on the M5 timeframe.

Conclusion

The Tokyo USDJPY EA offers Forex traders a sophisticated tool that combines strategic timing with rigorous risk management to exploit trading opportunities in the USDJPY currency pair effectively. By integrating advanced indicators like the RSI and adhering to a disciplined trading schedule, this EA promises to enhance trading strategies, ensuring both profitability and safety in the volatile Forex market. Whether you are a novice or an experienced trader, the Tokyo USDJPY EA is a valuable addition to your trading arsenal, ready to help you navigate the complexities of currency trading with confidence and precision.